One of the most widely watched market breadth indicators is providing a healthy sign for the ongoing U.S. stock market rally.

Michael Tarsala

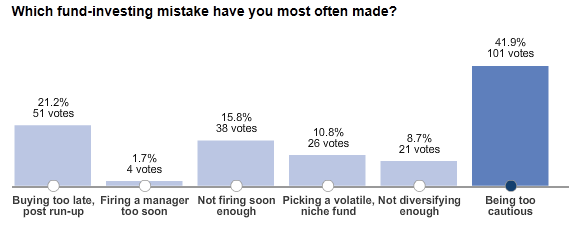

A Wall Street Journal poll reveals that by a large margin, investors believe their biggest mistake is being too cautious in the markets.

Hedge fund heavyweight William Ackman just unleashed a very detailed slide show presentation on REIT investments this week at the Value Investing Congress.

Hedge fund manager Whitney Tilson at T2 Partners warned this week that stocks might not have a big upward catalyst from here. Still, he sees long-term value.

Bill DeShurko, manager of the Dividend and Income Plus model, shares the screen he uses to help him find quality dividend stocks.

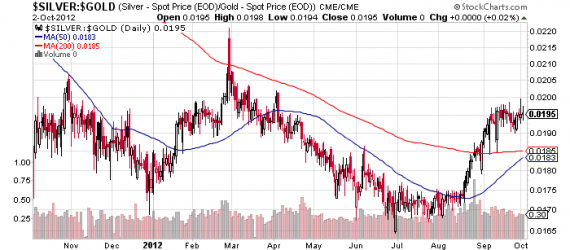

Economic worries have ebbed since August, but have yet to improve to the best levels of 2012 based on the all-important platinum/gold ratio.

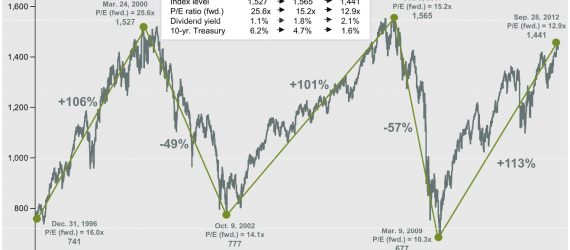

In one chart, here is why stocks may not be overvalued even after more than doubling off the 2009 lows and may still offer better value than bonds:

Trulia shares are up more than 20% from the company's IPO last week, but it's really not a special company, says investment manager Barry Randall.

Let winning stocks ride? Investment manager Scott Rothbort says it's time to bank some profits and to be careful not to chase stocks in the fourth quarter.

Even lower yields on U.S. Treasuries are possible, and they could help drive up the prices of dividend-paying stocks as an investment alternative.

The Russell 2000 may give us cue as to whether the S&P 500 and other major U.S. indexes will reach all-time highs in the coming months.