by Michael Tarsala

by Michael Tarsala

Prudent Investment management is an involved process with many steps. Screening for the right stocks is only going to take you so far.

Part of the reason is that investing involves choosing investments where you have reason to believe others will be buying in the future. It’s not simply about buying stocks that meet all of your checkboxes. Read this post for more background.

Screens can, however, help you to find stocks that meet certain quality criteria. If you are searching for an income-generating stock as an alternative to a bond, including dividends as part of your screening makes sense.

You can also include valuation screens to ensure that you are not overpaying for high-yielding stocks, ones with very strong growth rates, or ones that have simply become very popular.

Bill DeShurko at 401 Adviser runs the Dividend and Income Plus model at Covestor. Most investments in the model typically have above-average dividend yields. And almost all of them are less volatile than the S&P 500, based on their betas.

Bill uses the following screens to help narrow down his potential investment selections:

DIVIDEND YIELD: Above 3%. One thing companies simply cannot lie about, DeShurko says, is the cash they put in your hand. More cash is better, provided all the other criteria also check out.

BETA: Less than 1. He likes stocks with less volatility than the market as a whole. They may lag a bit in a market upturn, but they also tend to hold up better in a downturn.

P/E: 15 or less. Keep this ratio low. The current P/E ratio of the S&P 500 is 16.8. You should be able to pay far less if you’re willing to do the research.

FORWARD P/E: 15 or less. Do not overpay for future earnings, either. Keep in mind that the S&P 500 is at a forward P/E of 14.

EPS Growth: Positive. There’s no need to settle for shrinking companies, even when it’s yield that you are really after.

MARKET CAP: Over $300 million. Small companies can be suitable. But under $300 million, and you are looking at a traditionally volatile lot.

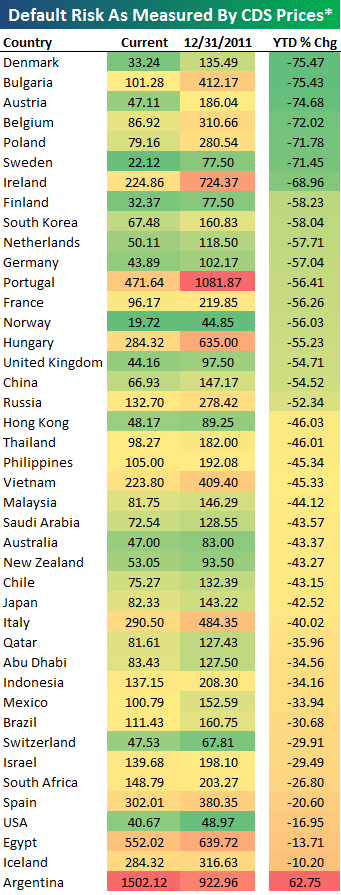

COUNTRY: USA-only. It’s not blind patriotism. The U.S. economy is holding up better than other industrialized nations right now, so buying stocks with heavy U.S revenue exposure makes the most sense.

The index comparisons herein are provided for informational purposes only and should not be used as the basis for making an investment decision. There are significant differences between client accounts and the indices referenced including, but not limited to, risk profile, liquidity, volatility and asset composition. The S&P 500 is an index of 500 stocks chosen for market size, liquidity and industry, among other factors.