by Michael Tarsala

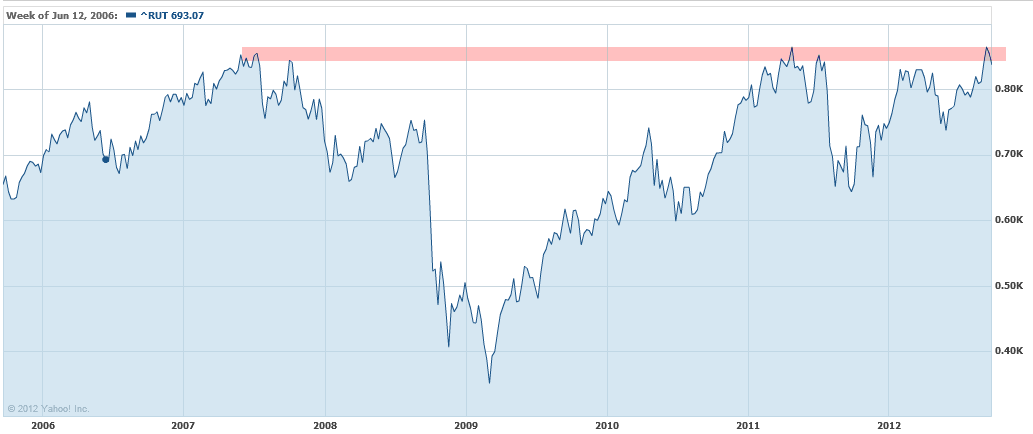

The Russell 2000 may give us cue as to whether the S&P 500 and other major U.S. indexes will reach all-time highs in the coming months.

The Russell is not an index you hear about every day. Yet it is one of the major U.S. indices, and one that provides the best measure of how smaller companies are doing. The median market cap for the Russell is pretty tiny at $528 million. It’s also in some ways a more U.S.-focused index, as very few of the stocks on the index have significant overseas operations.

Stocks on the Russell also tend to be more volatile than S&P 500 stocks. As a result, you might expect the riskier stocks to react more strongly to a risk-on environment than their larger brethren.

Stock bullishness overall is arguably on the rise. The Fed’s latest round of stimulus is one of the reasons that Todd Schoenberger from the BlackBay Group is among the market bulls. He sees the S&P rallying another 7% to close the year at 1,550.

Source: Yahoo Finance

Yet you can see that it’s the Russell that is the closest U.S. index to a breakout. It reached its highest intraday level since May 2011 in mid-September. It is now facing a long-term resistance rang going back to the 2007 highs.

A break above that resistance level might be seen as a positive sign for all U.S. stocks.

Source: Google Finance

It also could provide a warning, in that a failure of the Russell to break above those levels might make it less likely that the S&P could run past its 2007 highs.