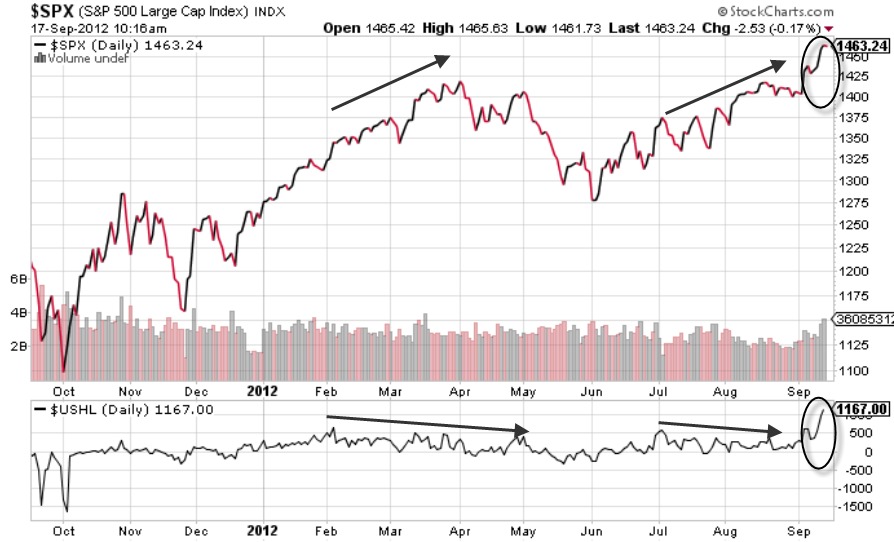

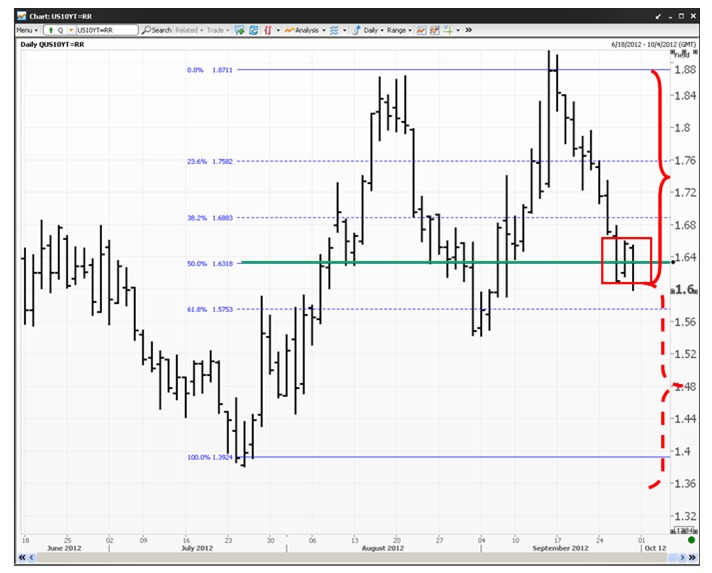

Even lower yields on U.S. Treasuries are possible, and they could help drive up the prices of dividend-paying stocks as an investment alternative.

John Kozey, CFA, CMT, is an analyst at Thomson Reuters. Based on a price-pattern analysis, he thinks the next stop for U .S. Treasury yields are their July lows, around 1.39%.

Source: Alpha Now

Source: Alpha Now

Retirees are probably hoping that he’s wrong.

Many count on yields of about 4% a year or more to cover their living expenses without subtracting from their capital. Getting those yields has been fairly easy to do in the past, with yields averaging 6.7% going back to 1962.

Municipal bonds typically yield more than Treasuries. Yet they, too have fallen meaningfully over the past six months. The average return of The Bond Buyer 20-Bond GO Index, made up of long-term muni bond issues, was 3.67%, as of September 27. The index average had been well over 4% for each of the previous nine years.

Another alternative to bonds is dividend-paying stocks. The dividend yield on the S&P 500 is about 1.95% right now, which is still far below the 4% or more that many retirees are seeking.

Yet there are some types of stocks that typically pay higher yields, including real estate investment trusts and some oil and gas investments. Covestor, for example, has 17 different investment models with an indicative current yield of 4% or above.

Those figures are based on the last known dividend and is shown as an annualized rate for all stocks in the investment model. It takes into account the cash held in the model, as well as long and short positions. For preferred shares, the yield to maturity is used. It’s not a measurement of the future yield, in other words.

Those stock investments typically carry more risk than bonds. Yet depending on your risk tolerance and goals, one or more could be an option as part of your overall investment mix.

For more information, give us a call at 866-825-3005 X 703. We would welcome the chance to talk to you about our investment models and to help you decide if they might be right for you.