by Michael Tarsala, CMT

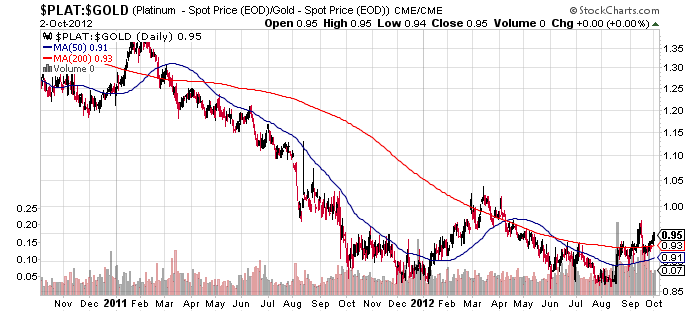

Economic worries have ebbed since August, but have yet to improve to the best levels of 2012 based on the all-important platinum/gold ratio. That stands in contrast to a stock market that has risen near a 5-year high.

Platinum/gold is a long-used reflection of economic bullishness, and a gauge watched by traders, analysts and economists. The higher the ratio, the higher the economic expectations among market participants.

There is a logical reason for this: Platinum is more rare than gold, so it usually trades at a premium to the yellow metal. When economic worries increase, however, the platinum premium to gold tends to get squeezed as investors seek gold’s perceived safety.

Also, platinum has many more industrial uses than gold does — it’s in many types of electronic equipment, as well as in catalytic converters on cars. So it also may decline when investors and traders are anticipating tough economic times. The Wall Street Journal’s Emily Clark addressed the ratio in a recent column, where she finds “a move back to lasting platinum price dominance is likely some way off.”

Source: Stockcharts.com

Source: Stockcharts.com

Gold has rarely been more expensive than platinum over the past three decades. Yet that has been the case for much of 2012. Platinum rose above gold briefly in February, March and April, but it’s been below gold’s price since then.

The trend has been to the upside, though, in recent months. Gold still trades at a premium, but platinum is now 95% of gold’s price, up from 86% in August.

Bottom line, a historically low platinum price relative to gold continues to reflect very low economic expectations — even though it has been moving in a positive direction in recent weeks.