by Michael Tarsala, CMT

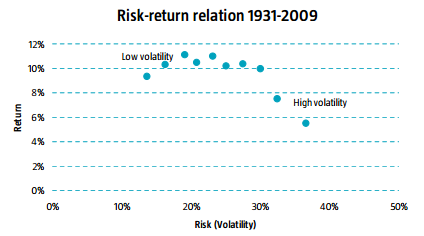

In one chart, here is why stocks may not be overvalued even after more than doubling off the 2009 lows and may still offer better value than bonds:

Source: JPMorganFunds.com

-

The S&P 500’s market’s forward P/E of 12.9 times earnings is less than half of what it was at the peak in March 2000, and significantly lower than what it was in October 2007.

-

The forward PE also is lower than it was at market troughs in December 1996, as well as in October 2002.

-

The stock market’s dividend yield is well above what a 10-year Treasury offers, which was not the case at the past two market peaks. Dividends can add significantly to returns over time.

-

The market’s dividend yield also is nearly double what it was at the March 2000 peak, and also more than in October 2007.