by Michael Tarsala

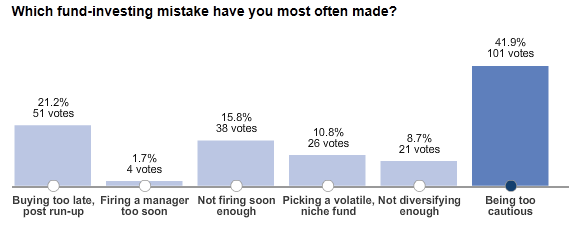

A Wall Street Journal poll reveals that by a large margin, investors believe their biggest mistake is being too cautious in the markets.

Source: WSJ.com

Many investors arguably have made that very error this year, choosing money market or bond investments over stocks in an effort to be smart and careful. Many investors missed the rally since June as a result that helped to send the S&P 500 up more than 16% since January 1.

A cautious approach to the market is a smart approach. No one would advocate taking imprudent risks. Keeping all of your assets in stocks and high yield bonds, for example, would not be recommended by most advisers, no matter your age.

Yet research suggests that investors are more likely to make a mistake by being far to cautious than being far to aggressive.

For many investors, it can be a wise idea to chase more aggressive returns with a small portion of their investments.

A good rule of thumb is to take 100 minus your age as the percentage of assets to allocate to the stock market, says Susan Garland at Kiplinger’s.

What that means, of course, is that even someone 60 years old and soon approaching retirement would still have 40% of their total holdings allocated to the stock market.

For many investors at 60, that may be a more aggressive asset allocation than they may have currently.