by Michael Tarsala

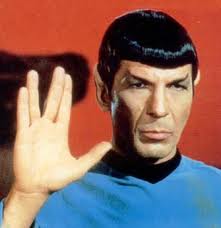

Americans are living up to the first half of the Vulcan greeting, “live long and prosper”.

That second part? Not so much.

Average life expectancy is now more than 78 years. And there’s a 50% likelihood that one partner in every married couple over age 65 will live to 94!

Yet only a little more than half of Americans feel financially prepared to live even to age 75, according to a study released by Northwestern Mutual.

Ever do your homework on how much money you’ll need to retire? Even middle-class Americans can quickly reach a seven-digit number.

As a rule of thumb, you’ll need a large fraction of your current income every year. Then you’ll need to adjust that number for inflation.

Whatever that annual number might be, multiply that by 25, so you can withdraw about 4% a year without out-living your nest egg.

You could factor in for social security (assuming it’s still there when you retire) and a planned drawdown in home equity.

But even with those moves, it can be hard to get to your recommended dollar figure to retire comfortably.

I talked to Susan Garland, editor of the Kiplinger’s Retirement Report, for her seven tips on making it securely to age 75:

1) Don’t forget 401k and IRAs

In New England, they call this one a no-brainah. If you’re in the 25% tax bracket, you save 25 cents in taxes alone for every dollar you put away in 401s and IRAs. Moreover, not maximizing your employer’s 401 match is the same as not taking part of your salary.

“The truth is, if you don’t have that money in your paycheck, you won’t spend it,” Garland says. “A good strategy is to start contributing in your 401 to maximize your employer’s match, then ratchet it up until 1% ever year until you get to 15% of your income. That way it’s pretty painless.”

2) Use catch-up contributions

2) Use catch-up contributions

Once you are 50 or older, you can put an extra $5,500 a year into your 401k, on top of the $17,000 you already are permitted. It’s much the same with IRAs, where you can put in an extra $1,000 on top of the regular $5,000 limit. The catch-ups can help you make up for past mistakes.

Plus, if you have a non-working spouse age 60 or older, consider opening an IRA in his or her name. You can sock away a maximum of $6,000 a year toward that IRA, as long as the working spouse earns enough to cover the cost of that contribution.

3) Don’t be scared of the stock market

People make mistake of dropping stocks completely at age 55 or 60, Garland says. But stocks have proven over history to be the best inflation fighters. You do want to decrease your stock exposure as you age, sure. But you cannot drop them: Stock gains can help sustain you if you live to 75 or older. Garland says the rule of thumb is that 100 minus your age should roughly be the percentage of stocks in your portfolio.

4) Stay diversified

One of the biggest mistakes investors make, Garland says, is when they load up on company stock. Another is when they load up on the large companies they know and love. The advice here is simple: Don’t do that! You need to diversify. That includes exposure to commodities, bonds, real estate investments, international holdings, emerging markets some small and mid-caps, as well as a mix of value and growth.

5) Build a cash reserve

As you get older, assuming you have retired, you’ll need some liquidity. Garland recommends keeping 2 to 5 years of living expenses in cash (or a CD, short-term bond fund or money-market account). One of the worst things that can happen is when you need to start drawing cash out of a diminished portfolio following a market crash. It’s money you are never likely to recoup. Plan ahead so that if the market goes down, you still have enough money to cover your living expenses.

6) Think about working a few years longer

It’s a dual benefit. You’ll increase your savings, and delay the day when you start drawing from your retirement.

7) Once you retire, buy an annuity

Consider buying an immediate annuity at retirement that will at least cover your fixed expenses including housing, taxes, utilities and health care premiums, Garland says. You’ll have an immediate payout, sure. But you’ll also have peace of mind, and more freedom with the remainder of your portfolio.

It will be worth it if you are among the growing number that live to 75 and beyond.