by Michael Tarsala, CMT

There are technical reasons to think stocks could outperform bonds in the near future, as now here’s a longer-term consideration that also gives the slight edge to stocks.

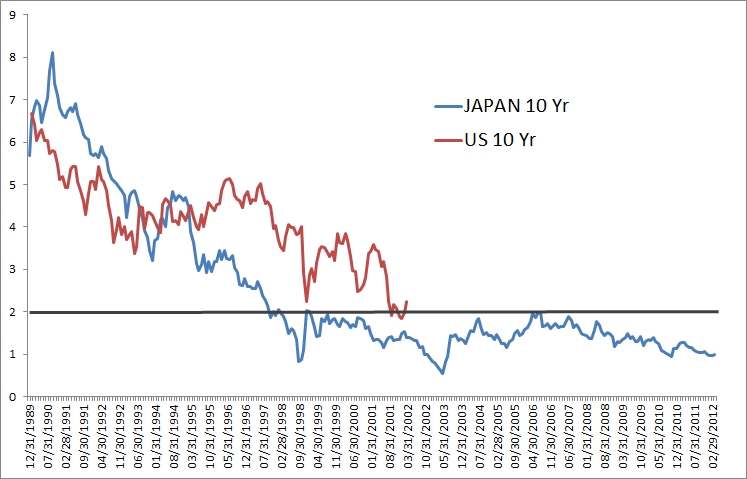

Portfolio manager and World Beta Blog author Mebane Faber suggests that Japan offers the best comparison for what may happen to U.S. Treasury yields in the years ahead.

Source: World Beta Blog

Above is Faber’s chart of Japan’s 10-year Treasury, in blue. And in red is U.S. Treasury yields plotted 10 years forward. That is, the U.S. series begins in 2000 when the Japanese series is at 1990. It makes the case that 2% U.S. Treasury yields could actually not be a floor, and that the yields may continue to collapse toward 0% over a full decade to come.

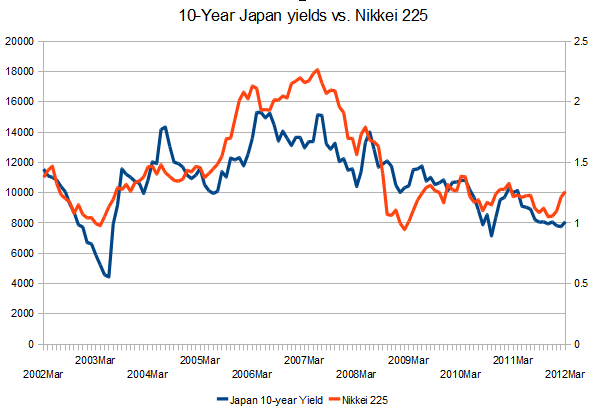

It begs the question: How did Japanese stocks fare the past 10 years, relative to Japanese sovereign debt?

Sources: Yahoo Finance, and European Central Bank

It’s not promising at all: Neither did well at all over the long-haul over the past 10 years.

But even in Japan, which has faced a deflationary environment, multiple global shocks, plus a tsunami and nuclear disaster, the Nikkei (in orange) outperformed Treasuries (in blue) over the past 10 years. There was only one period — the 2008 financial crisis — where bonds held a meaningful performance edge.

So even in a very poor, underperforming deflationary environment, there is an argument to be made for holding stocks over government bonds.