With the recent terrorist attack in Paris and speculation that more may come in Europe and the US, many are wondering if the world is on the precipice of a new major military conflict.

From an investor’s perspective, it begs the question: “What are some stocks that do well during wartime?”

Here are a few that I think could be interesting.

Defense Picks

I’ve listed these in the order in which I would recommend buying them.

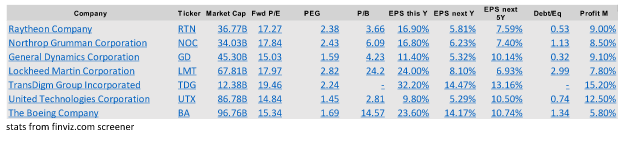

Looking back at 2001, when the attack on the World Trade Centers happened and in the months following, companies such as Raytheon (RTN), General Dynamics (GD), Northrop Grumman (NOC), and Lockheed Martin (LMT) all did very well.

United Technologies (UTX) and Boeing (BA) did not do well.

TransDigm

Those two fell along with the rest of the market as the economy was in recession from the bursting of the technology bubble.

For that reason, BA and UTX would not be my first choice. TransDigm Group (TDG) was not publicly traded at the time.

As far as just looking at the financial statistics, TDG is the fastest growing. However, since its balance sheet has more total debt than total assets, it is listed further down.

Lockheed

Lockheed has somewhat poor financial statistics. The high price to book ratio, as well as high debt to equity, indicate that the defense firm also has a much higher debt load than many of its peers.

Also, its net profit margin is on the low end of the group.

So, although I think Lockheed would do well during wartime, I like the top 3 companies more because of the strength of their financials.

After Paris

The performance of these stocks on November 16th, after the weekend news from Paris, I think gives a unique insight and preview as to what might happen to these stocks if there are additional attacks in the US and Europe.

RTN and NOC performed exceptionally that day, up over 4%.

For that reason I’ve ranked them as the best choices, with GD behind them based on the strength of their financials.

The investments discussed may or may not be currently held in client accounts.The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable.

Photo Credit: Moyan Brenn via Flickr Creative Commons