Stocks are near 5-year highs even as bonds are favored. How might stocks do if investor risk appetites increased?

Michael Tarsala

Investing is not a game of picking the winner of a beauty contest; it’s about choosing the winner the judges will select.

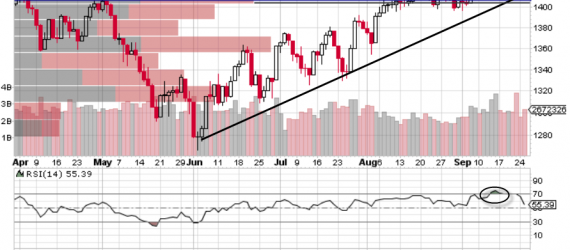

Tech stocks are still looking strong, says Covestor Manager Libardo Lambrano. Here are two key charts that would help to confirm his bullishness:

A second opinion. It’s often sought for medical advice, but not very often when it comes to investing decisions. That's unfortunate, and here's why.

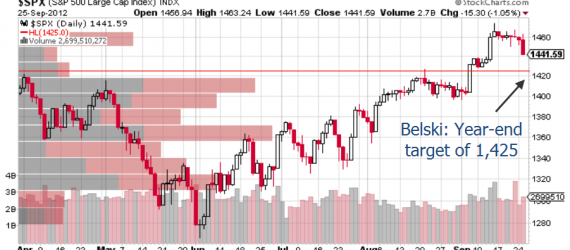

U.S. stocks just saw their heaviest selling day since June. Yet the price data suggest we're in for a minor pullback at this point, not a major one.

The relationship between initial jobless claims and the S&P 500 is critical. Here is what it's saying about the markets, the economy, and possibly QE3:

The Fed is giving a buy signal for risky asset classes including stocks, according to the latest quarterly research update from Barclays.

BMO's chief investment strategist Brian Belski sees possible near-term pain, but more long-term gains for U.S. stocks.

The big rally in Google shares while Facebook languishes says something positive about the stock market: It’s one sign that we’re not near a bubble.

A small number of 401k participants may be getting stuck with the bulk of the plan expenses. Covestor manager Matt Pierce sheds light on the complicated issue.

U.S. stocks stack up well vs. the rest of the world based on valuation, even as the price charts hint at the possibility of coming U.S. outperformance.

Two important signals are saying that stocks are not overbought at these levels and the longer-term market trend is still to the upside.