by Michael Tarsala

BMO’s chief investment strategist Brian Belski sees possible near-term pain, but more long-term gains for U.S. stocks.

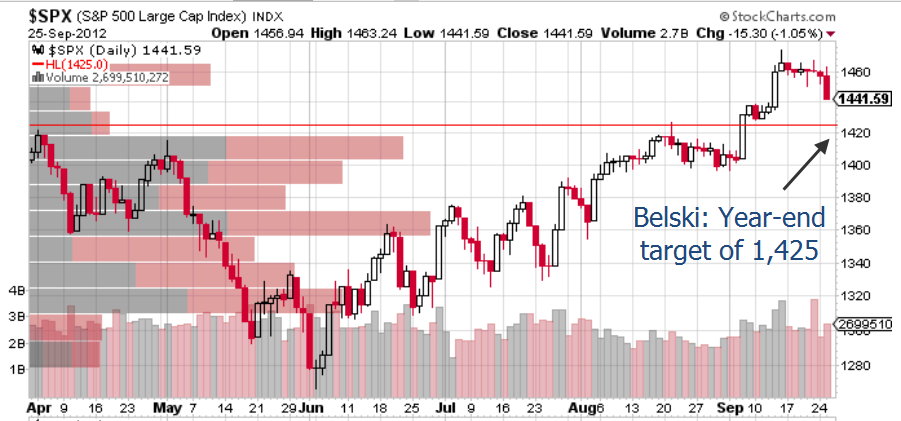

Following Tuesday’s market slide, its largest since late June, Belski told Bloomberg TV that institutional investors in recent weeks have bid the market higher ahead of the close of the third quarter in a “game of catch-up”.

He seemed to imply that money managers want their quarterly statements to reflect their exposure to a market rally.

Sources: Bloomberg TV, Stockcharts.com

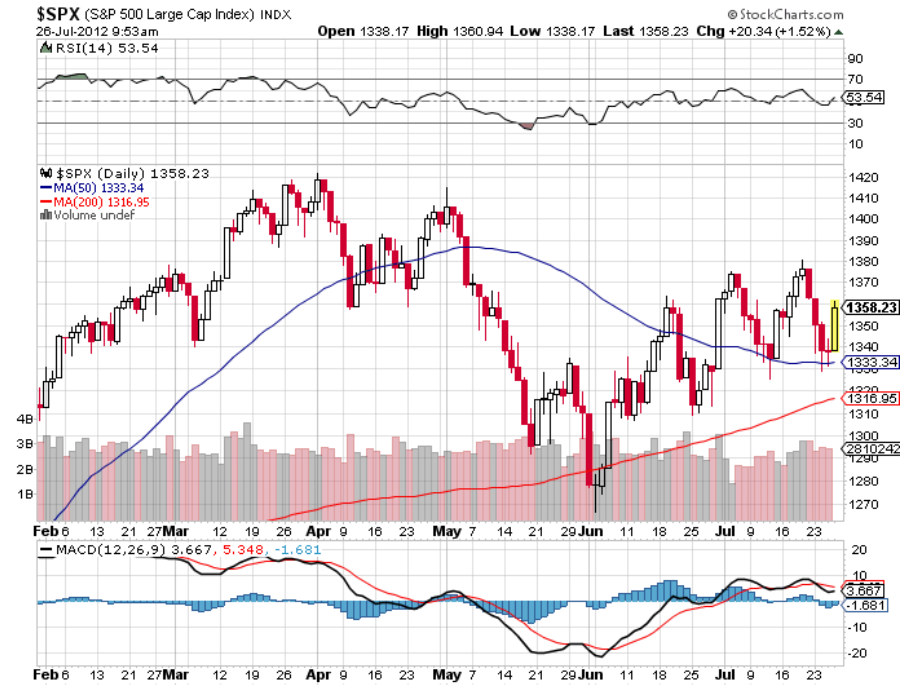

The market has run up hard and fast, however. His year-end target for the S&P 500 is 1,425, a little more than 1% below current levels.

“That does not make us bears. That does not make us negative, Belski said. “We think it’s going to be a noisy election season. And that’s going to cause some volatility short-term in the market.

Longer-term, U.S. stocks in particular still look very good from a fundamental perspective, he said.

Belski set an S&P 500 target of 1,575 for next year, more than 9% higher from its latest close near 1442.