There will be three large Treasury settlements on Tuesday, Thursday, and Friday. One can only make an educated guess as to where the funding will come from. Will the reserves take a hit?

Outlook

The ECB and BoJ held rates, signaling caution. UK retail sales rebounded slightly, but consumer sentiment and global growth indicators remain mixed, keeping markets on edge.

Stocks were under pressure from the opening bell on Friday as investors sorted through fresh tariff announcements from the White House, a softer-than-expected July jobs report, and mixed Q2 corporate reports.

Once again, the decision to keep the Fed Funds Rate at its current level comes as little surprise, as attention now turns to the next official FOMC gathering in September.

It appears the US is on the path to completing trade deals with the largest countries in the world which will change the terms of trade between the respective areas. And then there was the signing of the Genius Act.

Like a pilot advising his passengers to keep their seat belts buckled in case of potential air pockets, over the past two days, it seemed advisable to buckle up for a potential pop in volatility. Consider VIX to be the price of parachutes when a plane hits turbulence.

After a secular rise in equity prices in 2023 and 2024, extended valuations and high concentration laid the groundwork for factors to stabilize market excesses. In the context of risk efficiency, the factor-driven narrative becomes even more compelling.

Despite rising geopolitical risks, tariff threats, and shifting rate expectations, global markets remain resilient—buoyed by strong fundamentals, easing inflation, and tactical policy pivots across major economies.

This week brings numerous critical events, including key economic reports, significant Treasury auctions, major central bank decisions, high-profile earnings, and a court case reviewing presidential tariffs.

Two themes developed with fresh economic data released last week. First, June inflation data painted a mixed picture. The second theme revolved around consumers, who continued to be a source of strength for the economy.

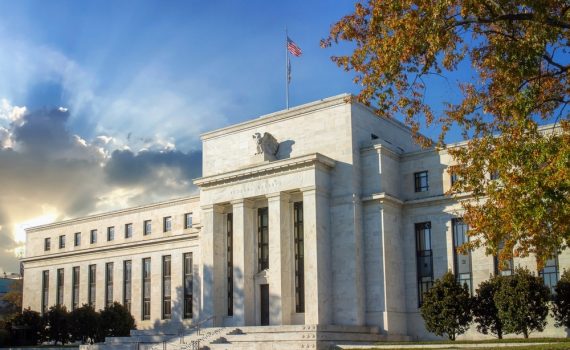

Governor Christopher Waller’s reminder this morning that he’d prefer a rate cut this month coincides with the White House looking for Fed Chair Powell’s replacement. And investors are taking it well.

On top of all the geopolitical headlines the money and bond markets have had to contend with of late, there has been another news story that has recently garnered its own fair share of headlines: a new Fed chair.