While the Fed’s communication toolkit has steadily expanded since 2000—from formal post-meeting statements to press conferences and quarterly projections—a deliberate rollback of forward guidance could reduce policy transparency but also curb market misinterpretations that have plagued rate forecasts.

WisdomTree

Despite political noise around Fed appointments, policy outcomes will still be driven by the FOMC’s data-dependent framework, suggesting investors should focus more on rates, liquidity and duration positioning than headline risk.

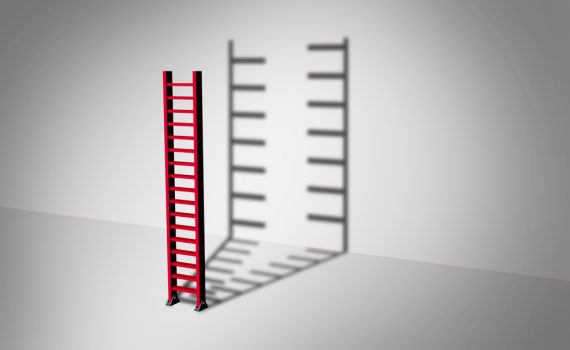

Within the fixed income arena, there are three key issues - one, yields returning to historically normal levels; two, chasing duration being a fleeting strategy; and three, the path of least resistance to be for the yield curve to steepen.

As we get ready to close out 2025, one stand-out trend in the U.S. Treasury (UST) market has been the steepening of the yield curve. The question now is whether this trend will continue into 2026, and if it does, how should investors position their bond portfolios?

While only two official dissenters opposed the December rate cut, dot-plot projections reveal that six Fed members, including four “silent dissenters,” were against easing, signaling deeper division within the Fed than headlines suggest.

After a year of overheated valuations and investor crowding, India’s equity market has undergone a healthy reset with more defensible valuations and renewed investor interest.

With the government shutdown temporarily resolved, market attention has shifted to whether the Fed will cut rates at its December meeting amid growing division within the FOMC.

If the labor market is nearing a bottom and job creation surprises to the upside, investors may need to rethink the consensus Fed path.

As the calendar has now turned squarely into Q4, the sweepstakes for who will be nominated as next Chair of the Federal Reserve will no doubt increase. Current Chair Powell’s term does not end until May 2026, but according to published reports, it looks like the Trump Administration could make an announcement as soon as January.

With the federal government shutdown delaying major economic data releases, investors are left navigating markets without key signals. While this shutdown does not include debt ceiling standoffs, it still clouds short-term visibility for the economy.

In the 20th century, power revolved around oil, steel and finance. In the 21st, it revolves around compute, certain design tools and semiconductors. For investors, this is both an opportunity and a warning. The rewards of scale, scarcity and sovereignty could be immense. But the risks are equally real.

With Fed policy remaining highly data-dependent at this stage of the game, getting policy to neutral is a good starting point. If the upcoming employment data doesn’t improve, or gets worse, in the months ahead, then the voting members will more than likely front-load their rate cuts and get them in before year-end…then on to 2026.