By Jeff Weniger, CFA, Head of Equity Strategy

It is no secret that so-called “impact” investors are gunning for the oil majors, or that Uncle Sam is salivating at the prospect of taxing the Silicon Valley giants, or that Big Tobacco is racing to get people vaping to reduce the stigma of its business model.

But when it comes to Chinese equity targets, whether by activists or regulators, the picture is murky.

Sure, a couple firms are notable for divestment headlines in recent years. One is Xiaomi, the smartphone maker, who the Western powers view as a security risk. Another is Huawei, the critical cog in telecom’s 5G rollout, which has been on the front page for a few years now. The picture is especially murky when you consider that the Chinese Communist Party (CCP) is still holding Canada’s “Two Michaels,” the businessmen held on trumped-up espionage charges in retaliation for the 2018 arrest of Huawei’s CFO at the Vancouver airport. Michael Kovrig and Michael Spavor could be executed if found guilty.

Beyond those two firms, there are many more companies with close ties to the state that have gotten the attention of Western politicians. In the waning days of the Trump administration, 44 Chinese companies with close ties to the People’s Liberation Army (PLA) were blacklisted. Notable among them are CNOOC, the energy giant, and China Mobile.

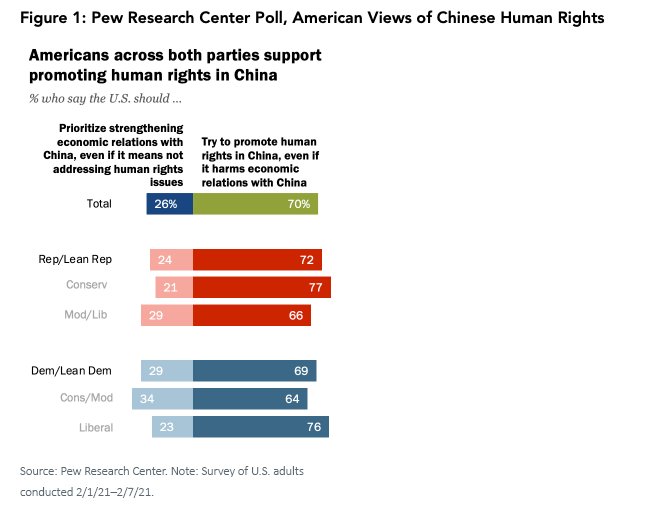

Can you think of any issue as universally bipartisan as China’s authoritarianism (figure 1)?

Because a chunk of our emerging markets equity business excludes all companies with more than 20% state ownership, we had none of the 44 PLA-affiliated companies in the WisdomTree Emerging Markets ex-State-Owned Enterprises Index or the WisdomTree China ex-State-Owned Enterprises Index.

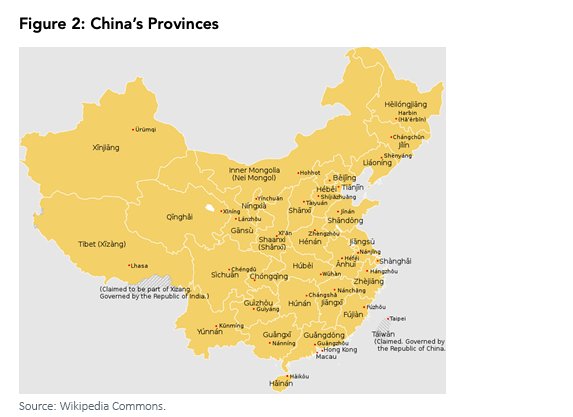

Another focal point are allegations of human rights abuses toward minority Muslims in the hinterland province of Xinjiang. In December, the European Parliament issued a statement saying “Parliament strongly condemns the Chinese government-led system of forced labour – in particular the exploitation of Uyghur, ethnic Kazakh and Kyrgyz, and other Muslim minority groups – in factories within and outside internment camps in the Xinjiang Uyghur Autonomous Region.”1

We believe the situation goes well beyond shoppers telling Sweden’s casual clothing brand H&M to stop sourcing cotton from that region, which grows 20% of the global supply. It could be viewed as a full-on societal pressure campaign on the CCP to abide by the global rules-based order. It is no stretch to forecast that the day is coming—or is already here—when Western capital treats China’s massive state-owned enterprises (SOEs) as it did the apartheid-era South African stock market—by rejecting them.

When the market takes fright at these ugly headlines, our research indicates it is often the SOEs that bear the brunt of the selling, as they are closest to CCP leadership.

Interestingly, when the market rages higher, the SOEs have also struggled. To wit, the SOE-heavy FTSE China 50 Index returned just 11.5% last year, a very different ballpark from the 61.1% run in the WisdomTree China ex-State-Owned Enterprises Index.

We hold no false illusions: Kicking out SOEs does not get the Party out of your portfolio. Just ask Alibaba founder Jack Ma, who has been largely “disappeared” since he gave a CCP-critical speech in October.

Nevertheless, a venture into our kick-out-the-SOEs strategies will help keep you away from many of the PLA-linked firms. It will also separate your capital from China’s megabanks, an investment decision that may prove fortuitous if the US, EU and allies such as Japan, South Korea and India open the sanctions playbook.

This post first appeared on May 25 on the WisdomTree blog.

Photo Credit: gags9999 via Flickr Creative Commons

FOOTNOTES

“EU Parliament Condemns China Over Uyghur ‘Exploitation,’” CNN, 2/17/20.

DISCLOSURE

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. CXSE focuses its investments in China, including A-shares, which include the risk of the Stock Connect program, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. The Funds’ exposures to certain sectors may increase their vulnerability to any single economic or regulatory development related to such sectors. As the Funds can have a high concentration in some issuers, the Funds can be adversely impacted by changes affecting those issuers. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

FTSE China A50 Index is a stock market index by FTSE Group, the components were chosen from Shanghai Stock Exchange and Shenzhen Stock Exchange, which issue A-share; B-share were not included. WisdomTree China ex-State-Owned Enterprises Fund seeks to track the investment results of Chinese companies that are not state-owned enterprises, which is defined as government ownership of greater than 20% Investors can’t invest directly into indexes.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.