The Dow Jones Industrials fell the most since June early Tuesday amid disappointing earnings and broad economic concerns.

It’s a broad selloff, with all 10 major sectors in decline. Fear has overtaken greed, with 3M (MMM) cutting its earnings outlook, United Technologies’ (UTX) concerns about airline demand and rising borrowing costs in Spain and Italy.

Yet Michael Arold, manager of the Technical Swing model, provides some needed perspective:

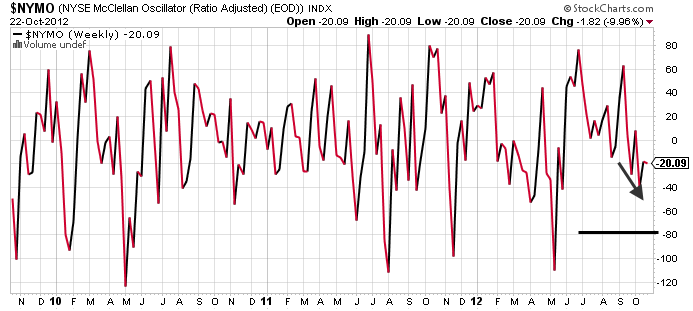

I’m mostly in cash… I would like to be more aggressive on the short side, but it won’t be a good trade to enter positions here. Sentiment is not in panic territory so far. My favorite indicators are not recording at extreme levels, but they are moving fast. For example, the McClellan Oscillator closed at negative 20 on Monday, but could approach extreme readings if stocks sell off hard today. A close below -80 would make me look for swing trades on the long side to benefit from a potential oversold bounce.

Of course, most investors are not like Arold. They are not paying attention to every market ripple. They have very little interest in the market’s short-term swings.

What’s encouraging to investors, though, is that a swing trader like Arold at this juncture is still looking for market upside, not extended downside.

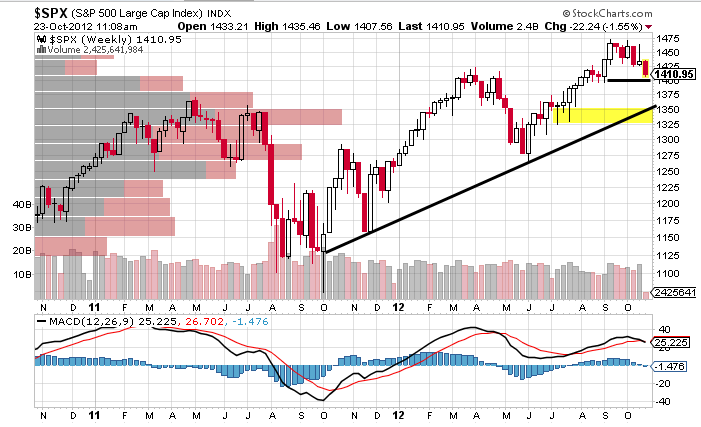

The minor support to watch on the S&P 500 is the March and May highs around the 1,400 level, marked by the black line. Below that, a decline may be possible to the volume support around the 1325 to 1,350 level, marked by the highlighted yellow bar.

Yet it would take a close below the 1,350 level before technical analysts would begin to call for the end of the market’s uptrend.