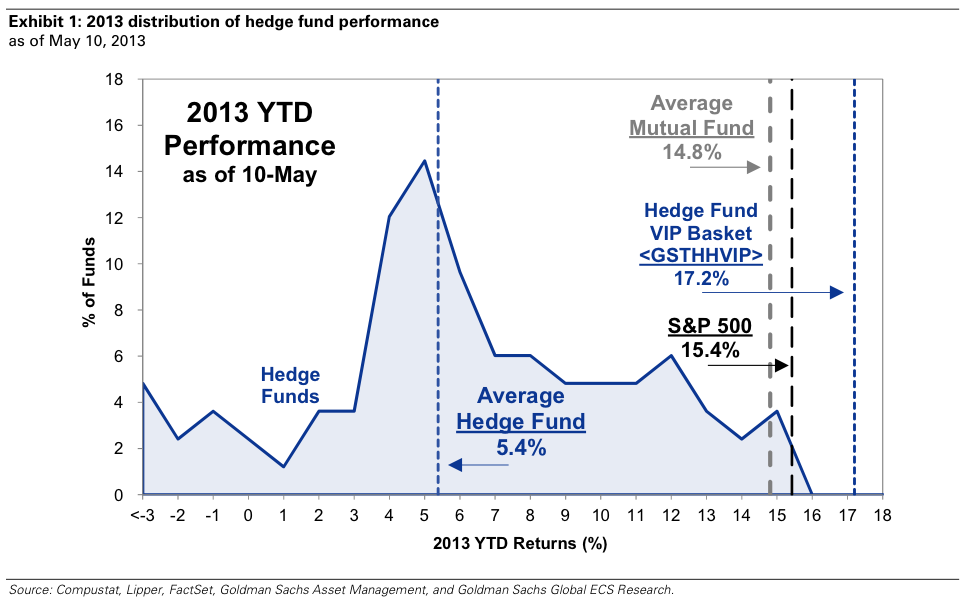

Hedge funds have had a hard time keeping up with the broad market indexes over the past ten years. Maybe this will be the year the hedgies break the cycle? Via Sam Ro, here’s a Goldman Sachs chart showing hedge funds’ performance so far in 2013 – click to enlarge:

Usually when you see figures about average hedge fund performance you don’t get a helpful broad breakdown like this – so you end up wondering how far the average was skewed by outliers. Here you can see that not only did hedge funds as a class underperform the S&P 500 by fully 10% through May 10, but only a small sliver of funds managed to outperform it – and that’s before hedge funds’ hefty fees, typically 2% of assets and 20% of gains. (Zero Hedge published a separate HSBC report from mid-April showing the outlier funds that managed to achieve 40+% gains through that date.)

Now, the Goldman report seems to include all types of hedge fund strategies – including Managed Futures, Market Neutral, etc. – which makes the fixed S&P 500 benchmark a bit unfair in some cases, especially when Goldman defines the ‘Average Mutual Fund’ as just large-cap core equity funds.

The ‘Hedge Fund VIP Basket’ is Goldman’s collection of 50 individual securities that “mattered most” to some of the largest hedge funds – that is, they were broadly held as top 10 positions in individual funds. Looks like they should have stayed more concentrated in those positions.