Value investors are often criticized for myopically focusing on bottom-up company fundamentals and ignoring the larger macroeconomic picture. While it is true that a typical recession is unlikely to seriously impair the value of most companies (especially those with strong balance sheets), we do believe it is important to be cognizant of the larger themes playing out in the global economy. A positive macro trend can reduce or even eliminate losses if you are wrong on an investment (effectively increasing the margin of safety), while a negative trend can turn a mistake into a disaster.

The investment world is currently obsessed over a never-ending series of European sovereign debt crises, a US fiscal cliff, and the apparent end of the Chinese investment supercycle. While these events are important, over the coming months we will explore in greater detail other important trends that are we believe are underappreciated and how they influence our thinking and portfolio positioning. As a preview, here in brief are three such trends in the US:

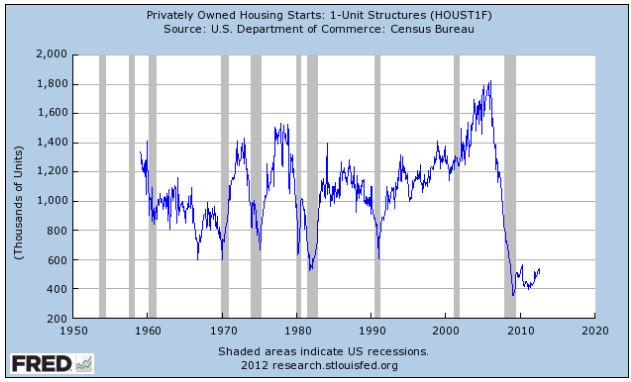

1) Nascent Housing Recovery – There’s been a lot of buzz in the media recently about a potential housing recovery. The home builder sentiment index is hitting levels not seen since 2006, and if you squint at the single-family housing start data, you can see that they are no longer scraping along the bottom, although we have a long way to go before we get back to something approaching normal.

We do not know yet if the uptick in construction is permanent, but any setback will likely be short-lived. The magnitude of pent-up demand for new home construction and the effect this demand will have on the broader economy are not fully appreciated by the market. In short, we believe that housing is becoming scarce and that the “right” housing (i.e., not abandoned Detroit homes or bubble-era structures far from population centers) is especially in short supply. Some of our holdings have directly benefited and we believe will continue to benefit from this trend.

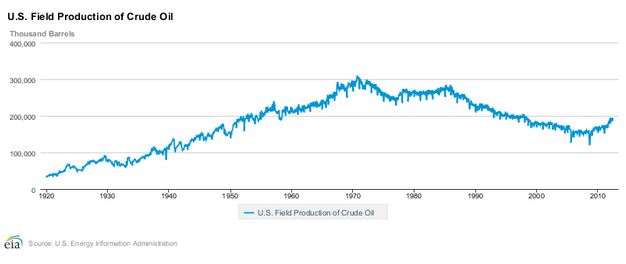

2) Ongoing Energy Revolution – In the last five years or so, domestic production of oil has rebounded, arresting a decline that has spanned decades. Just last week the Energy Information Administration announced that US petroleum production in the week ending September 28 reached 6.52 million barrels per day, the most since 1996.

Most of this new production is coming from shale and other tight (i.e., not very permeable) formations in which the twin techniques of horizontal or directional drilling and hydraulic fracturing (fracking) have proven to be truly disruptive technologies. Natural gas markets have been experiencing a similar production boom that has brought US prices down from over $10/mcf in 2008 to under $2/mcf earlier this year.

From an investment perspective, there are opportunities on both the production and the consumption sides, as users of energy benefit from cheap domestic prices. One of our holdings, Chesapeake Energy (CHK), is a play on the production aspect of this theme, while Masco’s and Berkshire Hathaway’s manufacturing operations should benefit from lower energy prices.

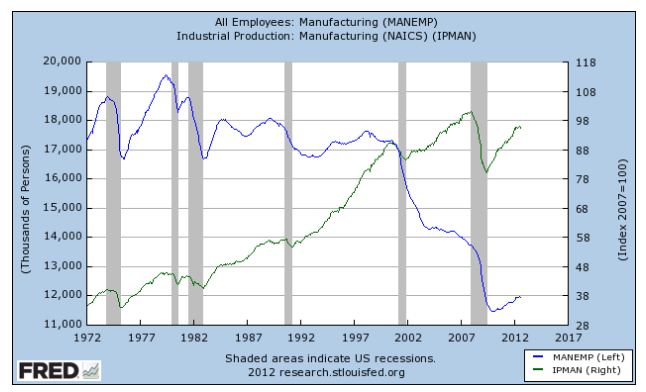

3) The Coming Manufacturing Renaissance – For many years, Americans have heard how large companies have been “shipping jobs overseas.” For the most part, this common refrain is true: growth in the real value of US manufacturing output has slowed over the last 15 years, and far few workers are needed than 30 years ago when the country’s production levels were half of today’s.

As most are aware, China has been a primary beneficiary of this process, becoming the workshop of the world. Less well known are the dramatic changes occurring within the Chinese labor force. The average hourly wage of a Chinese factory worker has increased fourfold from $0.50 in 2000 to $2.00 in 2010 and could reach $4.50 by 2015, while productivity is only increasing at roughly half that rate. In contrast, over this period manufacturing labor costs in the US have only increased ~2.5% when accounting for productivity gains. Couple this with the greater cost of transportation from Asia to North America and the other supply chain headaches that are common when sourcing from Asia, and we believe it will make increasing sense to manufacturer in North America goods that are ultimately destined for a North American market. Of our current holdings, Berkshire Hathaway’s US manufacturing operations should benefit from this trend.

These three trends are not the only significant forces shaping the investment landscape and are not the only areas in which we develop actionable ideas. However, as stated above, we believe they are underappreciated and worthy of further study.

Disclosures: The investments discussed are held in client accounts as of September 30, 2012. These investments may or may not be currently held in client accounts.The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable.

Certain of the information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Covestor believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.