In mid-July, the latest weekly Federal Reserve H.4.1 report was released. While the streak of lower weekly readings for the Fed’s balance sheet was broken, the increase was rather modest and the average size of the balance sheet actually shrank slightly during the week.

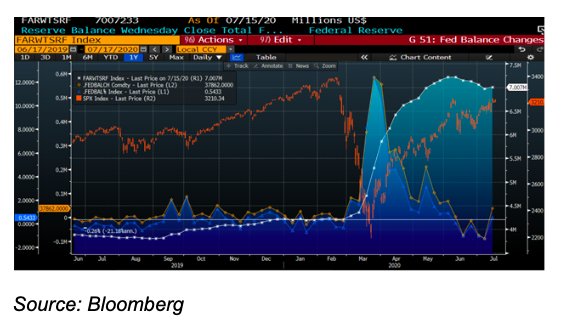

The picture below remains one of a central bank that has taken its foot off the accelerator:

Federal Reserve Balance sheet with weekly absolute and % changes alongside S&P 500

Fed’s Direction

One interesting feature of this week’s report is that the balance sheet contained no repurchase agreements. Remember that the balance sheet began to grow last August in response to a funding crisis in the repo markets. It now appears that the massive increase that arose in response to the Covid crisis has finally erased the need to intervene in that key funding market.

My investment thesis remains cautious based on the Federal Reserve’s willingness to let the balance sheet stagnate. This alone is not a reason to be bearish, but there remains a disconnect in the market. The prevailing narrative remains one of an endlessly accommodative Fed, but they are clearly not pumping more money into the system. At the moment their rhetoric remains more aggressive than their actions.

Economic Stability

I do share the consensus that the Federal Reserve will remain vigilant about the economy and would be supportive if economic stability is threatened. But remember, the stock market is not the economy. The Fed has never directly intervened in the equity market and has no mandate to do so. Thus, the “Fed Put” exists more in theory than in practice. There is no explicit mechanism for investors to sell their shares to the Fed as they have with exchange traded puts. Unlike the “Fed Put”, listed options have a defined strikes and expirations.

While the “Fed Put” is theoretically perpetual, which would be a true advantage, we also don’t know where it is struck. I contend that the market expects further action at the slightest sign of trouble in the market while the Fed would be inclined to act only if there are stresses in the economy – and a minor selloff in the stock market would not stress the economy sufficiently to spur Fed action. In other words, I believe that the “Fed Put” is struck far below where many market participants expect.

The belief in the “Fed Put” is reflected in the recent low readings in various put/call indices:

Takeaway

Rising markets bring anticipation of further gains, and investors are clearly adopting call options as a tool for speculating on continuing upside for stocks and indices. On the flip side, many investors seem to have decided that they don’t need to hedge with puts when the Federal Reserve will give you one for free. We can see from the chart above that dips in the put/call ratio are often followed by market pullbacks. The implication is that the market is showing an imbalance of greed versus fear.

As we head into an earnings season, this is of paramount importance. The market advance has been paced by a cadre of highly valued leaders with high market capitalizations that result in high index weightings.

Since markets typically punish companies that miss their numbers more than they reward those who beat them, the dual asymmetries of market and earnings risks portend a potentially rocky few weeks for equity markets. Much will depend upon how companies and their investors react to those risks.

Photo Credit: Kurtis Garbutt via Flickr Creative Commons

DISCLOSURE: INTERACTIVE BROKERS

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.