Retiring is a little like having children. If you wait for the right time, it will never happen. I say this as I have two children of my own with a third on the way shortly.

The middle of a pandemic-related recession isn’t an ideal time to be growing a family. It’s also not the best time to retire, but you may not have a choice in the matter. A lot of people have been forced to retire early due to the rough economy we’re in.

So here’s some advice to the recently retired. In my opinion, this is less a specific action plan than a collection of general guidelines. But hopefully this will help you get a little more prepared for your life in retirement than I am for the arrival of my baby girl!

Growth Vs. Safety

You’ve seen the statistics. The stock market “always” returns 8% to 10% per year over time. Or at least that’s been the case for the decades.

But even if we take these numbers at face value, the timing of those returns matter. Over a 30-year horizon, you might enjoy returns in that 8% to 10% range. But you’re going to get some nasty bear markets along the way.

That’s normally not a problem. If you’re taking something like 4% to 5% distributions from your portfolio each year, you have plenty of cushion. But if you hit one of those bear markets right at the beginning of your retirement, it can wreck your plans.

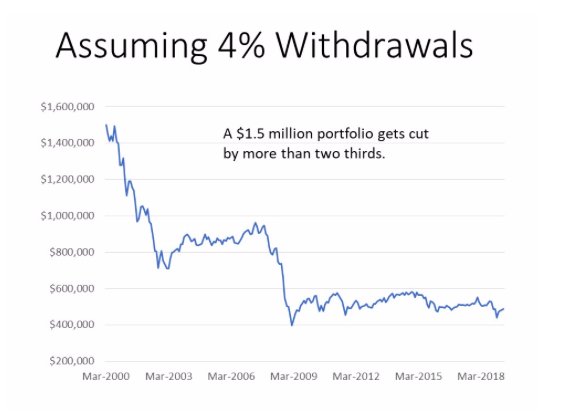

Here’s an example. Let’s say you had the great timing of retiring the day the 1990s tech bubble burst and that you had your entire portfolio in the S&P 500. You took normal 4% withdrawals to fund your retirement.

10 years into your retirement, you would have lost more than two thirds of your nest egg.

So, if you’re recently retired, do not put your entire portfolio into the stock market. I know bond yields are terrible today. I get that. But taking too much risk early in retirement isn’t worth it.

Don’t Chase Yield

I’ve always been a sucker for a high-dividend yield. But this is another area where you need to be careful. Divide the current annual dividend by the stock price to find the dividend yield. The yield can be high for one of two reasons:

- Either the dividend is exceptionally high;

- Or the stock price is exceptionally low.

More often than not in my opinion, the yield is high because the stock price is low… and it’s low for a reason. In my opinion, some of the highest-yielding stocks are often companies with serious financial problems at risk of cutting their dividends.

This doesn’t mean you have to avoid all high yielders in my opinion. As I wrote recently, I think REITs, business development companies, pipelines and other high-yield stocks have a place in a portfolio.

Just be smart about it, and make sure you’re not overconcentrated. My general rule of thumb is that no single stock should be more than about 5% of a portfolio. And no single sector or strategy should be more than 20%.

This article first appeared on July 13 at Money & Markets.

Photo Credit: Richard Walker via Flickr Creative Commons

Disclosure: This publication may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially.

No statements in this publication are intended or should be construed as tax advice.