After a robust performance in December 2023 for U.S. equities, January 2024 experienced some relative weakness due to repositioning prompted by mixed signals with macroeconomic data.

January has become a period in which the market is trying to establish stability. The surprisingly robust Non-Farm Payroll data (NFP) have cast doubt on the path of future interest rate reductions. Even though recent Federal Reserve remarks seem more hawkish, which was prompted by the labor data, Fed officials acknowledge projections that suggest potential cuts by the end of 2024 as the effects of their restrictive policy stance have started to take hold. They’ve concluded that the policy rate might be at or close to its peak, but they also expect to maintain a tight monetary policy for a while to reduce inflation to 2%, or close to that figure, aiming for the challenging yet increasingly feasible soft landing.

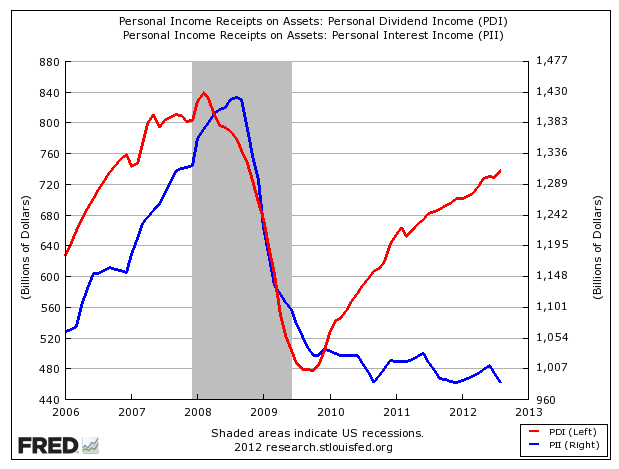

Undoubtedly, the progress in curbing inflation has been substantial. It is worth revisiting that not too long ago, inflation reached 9.1%, but recent readings show Consumer Price Index (CPI) inflation at 3.1%. In the first days of January trading, the long end of the Treasury curve shifted upward, while the 10-Year Treasury yield fell from 4.9% to 4.4%.

A decline in inflation would be advantageous for fixed-income securities. Additionally, a soft landing with lower interest rates will benefit equities, particularly those more reliant on the capital markets. And this is our expectation.

Originally Posted January 10th, 2024, GlobalX

PHOTO CREDIT: https://www.shutterstock.com/g/HTWE

Via SHUTTERSTOCK

Footnotes:

All data sourced from Bloomberg as of December 31, 2023.

Disclosure

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.