by Michael Tarsala

Wall Street analysts appear to be bracing for a decline in record corporate profits, backing investor John Hussman’s view that what goes up must come down.

Here is the latest from Thomson Reuters:

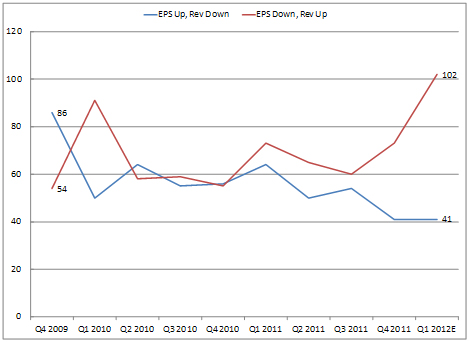

Source: Thomson Reuters Alpha Now

The blue line in the chart above shows the number of S&P 500 companies that have reported higher earnings on lower revenue. And in red are the number of companies reporting lower earnings on higher revenue.

The chart also incorporates Q1 mean analyst expectations.

And here is what’s striking: The red line’s spike. It shows that more companies are expected to boost sales and still report lower Q1 earnings. It’s reflecting the Street’s margin worries.

Now it’s true, long-term trends rarely turn on a dime. Covestor manager Bill DeShurko recently argued that there would be multiple warning signs before a U.S. earnings collapse.

The bull case for a high margins now and in the future include:

- Record government stimulus adding to the economy and companies’ bottom lines

- Very little corresponding corporate wage pressure

- Potential for even lower costs if there is a corporate tax overhaul

The bear case, however, now includes the following:

- More companies issuing profit warnings than upbeat guidance for Q1

- Rising fuel costs that could crimp profits at cyclical companies

- Renewed concerns about weakness in Europe

DeShurko still holds that there’s no imminent earnings collapse.

But he says if Q1 does goes badly, that could be a call to move into lower volatility stocks, such as ones in the PowerShares S&P 500 Low Volatility ETF (SPLV), utilities including ones in the Utilities Sector SPDR (XLU) and more preferred stock, such as ones in the iShares S&P U.S. Preferred Stock Index (PFF).

As always, talk to a financial adviser about proper diversification and preparedness.