By Michael Tarsala

Record corporate profits simply cannot last forever. That said, the market will likely provide cues about when it’s time to get far more defensive, says Covestor model manager Bill Deshurko at 401 Advisor.

The chart you see below is the latest from John Hussman, known for predicting the 2008 recession. It makes the case for shrinking profit margins going forward.

Source: Hussman Funds

The blue line shows unprecedented corporate profits on the left scale. And on the right is an inverted scale of profit growth 5 years out. You can see that going back 64 years, Hussman’s research reflects a strong inverse correlation. When profit margins rise, future profit growth falls. It makes a visual case for declining margins in the future, which could be a threat to stock prices.

Factors contributing to high margins now and perhaps in the near future include:

- Record government stimulus adding to the economy and companies’ bottom lines

- Very little corresponding corporate wage pressure

- Potential for even lower costs if there is a corporate tax overhaul

DeShurko also has talked about getting a bit more defensive recently. Last week, he named the chart formation that would cause him to convert 20% of his investment model to cash.

That said, he is not panicked about the corporate profit picture, or the economy at large right now.

DeShurko has two favorite macro indicators. One is the Chicago Fed National Activity Index, which measures the broad economy and inflationary pressures. Its latest reading shows above-average economic growth, with limited inflation in the coming year.

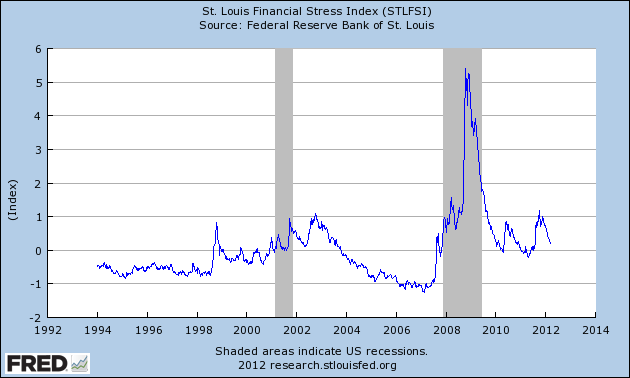

The other is the St. Louis Finanical Stress Index, which combines 18 different measures of systemic risk. As you can see below, the index reflects a declining overall stress level since the end of last year.

Should Q1 earnings guidance get suddenly pessimistic, or his two top risk indicators head the wrong way, DeShurko says that could be a call to move into lower volatility stocks, such as ones in the PowerShares S&P 500 Low Volatility ETF (SPLV), utilities including ones in the Utilities Sector SPDR (XLU) and more preferred stock, such as ones in the iShares S&P U.S. Preferred Stock Index (PFF).

But for now, he sees no imminent danger of an earnings collapse. He continues to seek stable value and high yields.