The adage “Go Away in May” is still in play, especially this year given the prospect that the US Federal Reserve may raise interest rates soon.

The “go away” crowd recommends that investors reduce their market exposure in May, ahead of the summer doldrums and return to the market in the fall.

One is selling not necessarily to avoid losses, but rather because there is not much to gain in this lower volume period.

Trend Analysis

Historically, there is evidence that the stock market does indeed languish in the summer months from May to September.

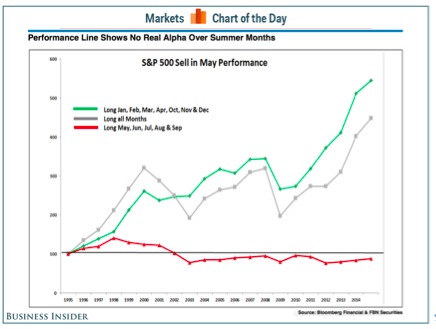

FBN Securities analyst JC O’Hara ran the data over the last 20 years for the S&P 500 Index and charted the returns.

Historically, performance for the summer months was negative. Of course, this doesn’t work every year.

And the chart clearly demonstrates, just staying long throughout the year, and not trying to time the market, is a pretty effective strategy as well.

Mid-Cap Performance

So far this year, the best two places to be in the market have been the NASDAQ Composite and in Mid Cap stocks.

The NASDAQ finally broke above the 5,000 level for the first time since March of 2000.

One big reason for the more than 5% advance in the NASDAQ Composite this year is Apple (AAPL) stock. This biggest name in the index has gained more than 15% YTD through April.

Here’s what is driving returns in mid-cap stocks: solid fundamental results.

Solid Earnings

According to analysis by Bank of America-Merrill Lynch, with nearly 60% of Mid Cap stocks reporting, earnings season has gone pretty well in Mid Cap land.

Earnings are up 6.1% with results topping consensus by 4%.

Those results look even better when you back out the weak energy sector, with earnings growth of 7%.

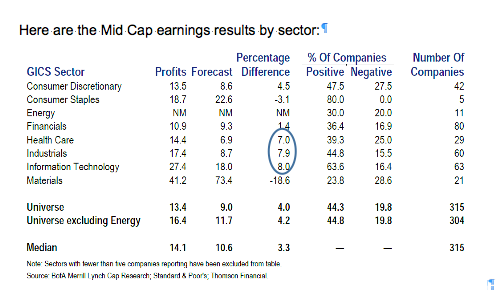

Here are the mid-cap sector earnings results for the first quarter:

Within Mid Cap, healthcare, industrials, and information technology sector profits came in handily above analyst expectations.

Portfolio Performance

The EQM Capital Mid Cap Quant portfolio was up 8.3% net of fees year-to-date through April versus 3.3% for the S&P 400® Midcap Index.

Among the top five portfolio holdings was cyber security solutions provider Fortinet (FTNT), which reported strong earnings in April thanks to record billings and large-enterprise deal growth.

Despite favorable earnings results, the cardiovascular device company sold off along with other high-flying healthcare names in the month of April.

Active versus Passive?

Finally here is some commentary about active versus passive management this year.

After 2014, a year when 86% of active managers failed to beat their benchmarks, active management is faring much better in this choppy, stock-picker’s market.

Active managers tend outperform when there is less correlation between sectors and within sectors. And active managers have outpaced passive funds in rising interest rate environments as well.

So far this year active managers are outpacing the indices.

According to Lipper, the average equity fund was up 2.48% in the first quarter versus only 0.8% for the S&P 500.

So regardless of capitalization size, I believe 2015 is setting up to be a year that favors active portfolio management over passive investing.

Photo Credit: Bfishadow via Flickr Creative Commons

Any index comparisons provided in the blogs are for informational purposes only and should not be used as the basis for making an investment decision. There are significant differences between client accounts and the indices referenced including, but not limited to, risk profile, liquidity, volatility and asset composition. The S&P MidCap 400® provides investors with a benchmark for mid-sized companies. It measures the performance of mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

The investments discussed are held in client accounts as of May 15, 2015. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.