Kevin Flanagan, Head of Fixed Income Strategy

Without a doubt, one of the more noteworthy developments in the financial markets of late has been the plunge in U.S. Treasury (UST) yields. Only a month or so ago, investors were looking at 5% yield levels, or close to it, along most of the UST maturity spectrum. In fact, some prognosticators were even mentioning that a 6% UST 10-Year yield shouldn’t be ruled out. So, the natural question to ask is: what happened in such a short period of time?

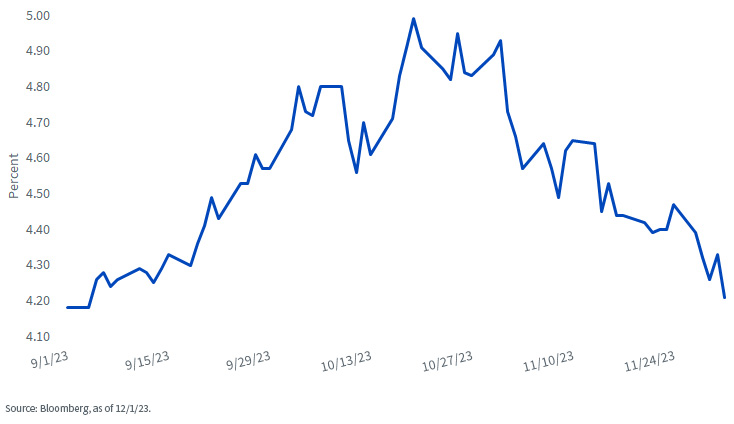

U.S. Treasury 10-Year Yield

Let’s go to the videotape for some perspective. As the graph highlights, the UST 10-Year yield has now essentially reversed the entire increase it experienced in September and October. Just what did that entail, exactly? A move of roughly 80 basis points (bps), first to the upside, and now to the downside. Remember, how I blogged about volatility in the bond market last week? Well, it doesn’t get more volatile than that in bond-land.

Typically, a reversal in yields of the magnitude we are discussing, especially in such a relatively short period, would require a sea-change in some key ingredient such as the economy, inflation and/or monetary policy. While the pace of economic growth does appear to be slowing from Q3’s robust reading of 5.2%. Based on the St. Louis Fed GDP Nowcast estimate, it looks like real GDP for Q4 could still be coming in just under 2%, or not too far removed from the first six months of 2023. With respect to inflation, progress continues on this front as well, but the most recent annualized reading on the Fed’s preferred inflation gauge, the core PCE Price Index, came in at 3.5%, or still visibly above the policy maker’s 2% target.

So, that leaves us with the monetary policy quotient and, no doubt, this is where the outlook has shifted dramatically. The money and bond markets have now moved up the timeframe for the first Fed rate cut and increased the cumulative amount of expected decreases for the Fed Funds trading range for 2024. To provide perspective, March of next year is now being viewed as the beginning of the rate cut cycle rather than June/July previously. In addition, the implied probability for Fed Funds Futures has now priced in five or six rate cuts for 2024, for a total of about 125 to 150 bps. In comparison, as recently as October 31, expectations were geared toward three rate cuts worth roughly 75 bps in total.

Conclusion

Arguably, one can make the case that the UST market has already priced in a lot of good news, so in order to maintain yields at current levels (or even lower), validation will be necessary. What does that mean? Economic/labor market data needs to reveal a visible slowing in growth while inflation must continue to show signs of further cooling. These two forces will be necessary for the Fed to begin their forward guidance toward rate cuts, let alone actually lowering the Fed Funds rate. In my opinion, the money and bond market’s newfound optimistic monetary policy outlook may be ripe for some disappointment.

This post first appeared on December 6th, 2023 on the WisdomTree blog

PHOTO CREDIT:https://www.shutterstock.com/g/olivier26

Via SHUTTERSTOCK

Disclosure:

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.