By: Steve Sosnick, Chief Strategist at Interactive Brokers

It’s taking markets a little bit of time to fully digest the ramifications of last Friday’s payrolls report. Short-term interest rates and the dollar are continuing their rapid advances today, but it appears that equity traders are torn between nervousness and the recent rekindling of their love affair with buying dips. I tend to write these pieces in the morning, after markets open, and like Friday we are seeing a bounce off the lows sometime around 10:30 EST. That said, Friday’s attempted rally failed as the S&P 500 (SPX) approached unchanged levels, while this morning we are stalling (so far) around -1/3% lower.

It is important to keep in mind how much volatility we have seen in a relatively short period of time in assets that are usually considered to be low risk. The gyrations in 2-year Treasury yields have been quite a ride, for example. We see rates steady at 4.20% coming into the FOMC meeting on Wednesday, dipping to 4.10% that afternoon after a brief head-fake, then making a move toward 4% on Thursday before reverting to 4.10%. Yields popped to 4.25% in the immediate wake of Friday’s payrolls report and have been rising steadily toward the current 4.43%. We see the US dollar, as measured by the US Dollar Index (DXY), following in relative lockstep, moving from 102 to 101 to 103.64 in the same four-day timeframe.

4-Day Chart, 2-Year US Treasury Note Yield (white), DXY Index (blue)

Source: Bloomberg

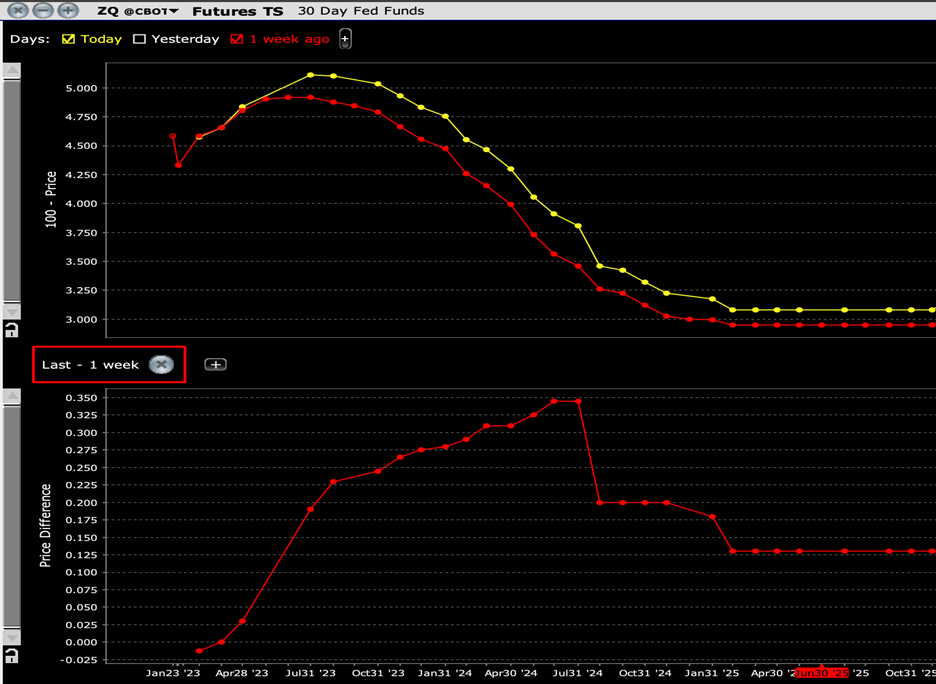

The underlying cause of these moves is some newfound uncertainty that has permeated the Fed Funds futures market. The chart below shows how the market’s anticipation for peak rates has risen from 4.92% last week, prior to the FOMC meeting, to 5.11% today. That is roughly one more rate hike being priced in. We still see rate cuts being priced in for later this year, but they are slightly less aggressive and beginning from a higher peak. (By the way, for any of you who might be holding out for a return to the zero rate regime that once prevailed, Fed Funds futures harbor no expectation of that in the foreseeable future).

Fed Funds Futures Term Structure, Today (yellow, top), 1-Week Ago (red, top) with 1-Week Differential (bottom)

Source: Interactive Brokers

Still, US equities remain relatively unperturbed. Sure, we ended about 1% lower on Friday, but unlike bonds and currencies, SPX remains well above its pre-FOMC level. For the past few weeks, stock traders have been aggressively chasing momentum. We have asserted that the “January effect” was a key positive catalyst as the calendar turned – which is a key explanatory factor behind the year-to-date outperformance of some of 2022’s biggest decliners – but the positive momentum has taken on a life of its own. A “better-than-feared” earnings season has been a key contributor, to be sure, but that hardly offers a full explanation about the moves in some unprofitable companies and non-yielding assets.

SPX 4-Day Chart, 1-Minute Bars

Source: Interactive Brokers

We have often asserted that “if safe assets are getting clobbered, risk assets don’t stand a chance.” This was a key explanation for the lousy performance of equities and riskier assets during 2022. Risk-free rates are a key component of nearly every asset pricing model. If they rise sharply, that should negatively impact the value of the riskier asset that is being valued.

But we also know that while equity prices should be negatively impacted by higher short-term rates, do we really think that traders of ES and NQ futures, let alone those trading zero-dated options or low-quality, high-beta stocks are modifying their momentum-based strategies to reflect perceived changes in discounted cash flows or dividend discount models? Of course not.

That is why equities can make extended moves that seem to fly in the face of broader macroeconomic trends. Disinflation can indeed be a positive factor behind equity prices, but higher rates are not, nor is a stronger dollar a positive for earnings at the multinationals that dominate key US index weightings. Eventually, fundamentals take hold. Eventually, equity investors will need to decide if they actually want a rate cut if that implies a recession. But for now, momentum seems to be the deciding factor, even as higher rates are once again a key backdrop.

Originally Posted February 6th, 2022, IBKR Traders’ Insight blog

PHOTO CREDIT:https://www.shutterstock.com/g/adam121

Via SHUTTERSTOCK

DISCLOSURE: INTERACTIVE BROKERS

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers LLC, its affiliates, or its employees.

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

In accordance with EU regulation: The statements in this document shall not be considered as an objective or independent explanation of the matters. Please note that this document (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and (b) is not subject to any prohibition on dealing ahead of the dissemination or publication of investment research.