By: Stefano Maffina, ESG Analyst and Sakshi Borikar, SSGA

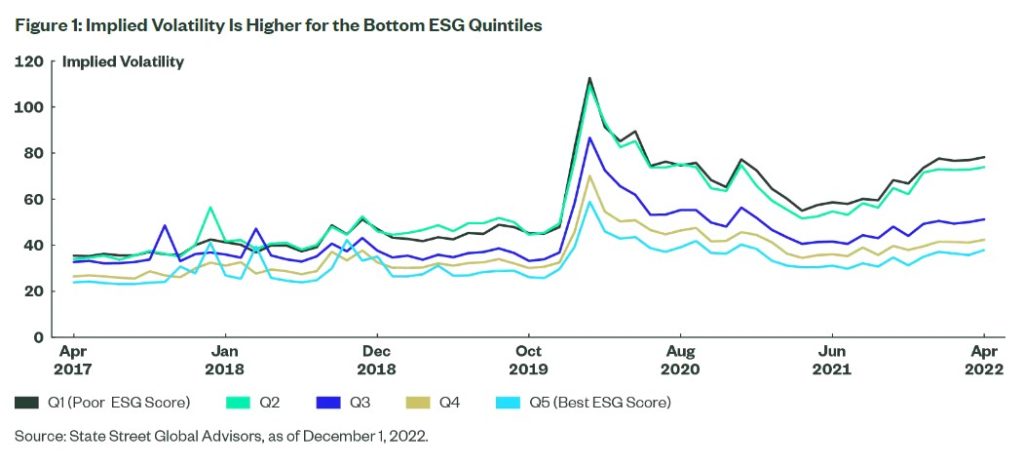

One of the most pressing investor questions is how environmental, social, and governance (ESG) risks translate into performance volatility for individual stocks. In this article, we tackle that question using the State Street Global Advisors proprietary ESG framework, R-Factor™.

To date, the literature on ESG has largely focused on the impact of ESG exposure on returns, and little has been done to directly assess the impact on risk. If we consider risk as any form of uncertainty, and further recognize that ESG by its very nature is influenced by corporate activities that impact stakeholders, then it stands to reason that there is a direct link between the management of the dimensions of E, S, and G, and the range of potential impacts on stakeholders. We then posit that companies neglecting to manage their ESG exposures may be exposed to higher future risk — particularly stock price performance risk — than their more ESG-focused counterparts.

We used our proprietary R-Factor™ scoring model to break a large universe of stocks into top- and bottom-ESG quintiles, and we took a data-driven, closer look at the relationship between ESG and volatility.

Figure 1: Implied Volatility Is Higher for the Bottom ESG Quintiles

Our data also shows that companies with better ESG performance are more resilient in high-volatility environments.

This post first appeared on January 10th, 2023 on the State Street Global Advisors’ blog

PHOTO CREDIT: https://www.shutterstock.com/ai-image-generator

Via SHUTTERSTOCK

Disclosure

State Street Global Advisors Global Entities

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the Markets in Financial Instruments Directive (2014/65/EU). This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Investing involves risk, including the risk of loss of principal. The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent. The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

The returns on a portfolio of securities which exclude companies that do not meet the portfolio’s specified ESG criteria may trail the returns of a portfolio of securities which include such companies. A portfolio’s ESG criteria may result in the portfolio investing in industry sectors or securities which underperform the market as a whole.

All material has been obtained from sources believed to be reliable. There is no representation or warranty as to the accuracy of the information and State Street shall have no liability for decisions based on such information.

The trademarks and service marks referenced herein are the property of their respective owners. Third-party data providers make no warranties or representations of any kind relating to the accuracy, completeness, or timeliness of the data and have no liability for damages of any kind relating to the use of such data.