It’s been a rough May for the US stock market, thanks to rising US-China trade tensions.

Now, technical analysts are worried the US bond market may be flashing a red alert about a possible future recession.

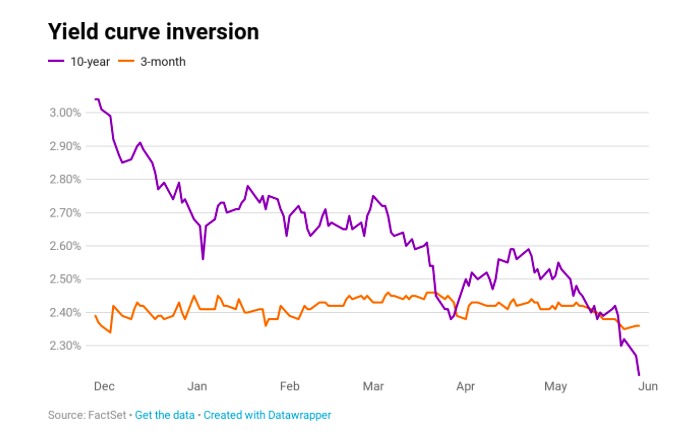

What has some observers anxious is the return of the dreaded inverted yield curve, in which short-term rates are now higher than long-term Treasury notes.

Topsy-Turvey

Think of the yield curve, a plot line of short- and long-term interest rates, as an early warning system from the broader US economy.

Yield curve inversions in the past have been an omen of a looming economic downturn.

What’s worrisome is that the current inversion between the 3-month Treasury bill and the 10-year Treasury note is at the deepest level since the 2008 financial crisis.

Warning, Warning

Why does this matter?

As Bloomberg points out:

“The yield curve has historically reflected the market’s sense of the economy, particularly about inflation. Investors who think inflation will increase will demand higher yields to offset its effect. Because inflation usually comes from strong economic growth, a sharply upward-sloping yield curve generally means that investors have rosy expectations. An inverted yield curve, by contrast, has been a reliable indicator of impending economic slumps.

Recession Watch

Strategists at Morgan Stanley, according to recent post on Barron’s com, argue the shift in the yield curve means US economy should be placed on “recession watch.”

What’s more, investors should brace themselves for more stock market volatility over the next six months.

Takeaway

According to research from the San Francisco Fed, every recession of the past 60 years has been foreshadowed by an inverted yield curve.

There has only been one false positive, back in the mid-1960s when an inversion was followed by a shallow slump that didn’t rise to the level of an official recession.

Nobody has a crystal ball, and it’s impossible to know for sure whether the US economy is heading for a downturn.

Yet the current business expansion is pretty mature and recessions are a fact of life. In my opinion, that’s something to think about as you manage your portfolio in the months ahead.

Photo Cedit: Zooey via Flickr Creative Commons