In the world of investing, the active vs. passive debate has taken on almost religious overtones, and it’s impossible to get either side to agree on, well, anything.

We’re talking Coke vs. Pepsi here. Microsoft vs. Apple. What condiments are “correct” to put on one’s hot dog. Or, what happens when you put diehard Star Wars fans and “Trekkies” in the same room.

However, getting bogged down in the never-ending active vs. passive squabble is counterproductive and can cause investors to lose sight of the big picture. Like dealing with a passive-aggressive person, sometimes the best thing to do is ignore these ideological zealots.

Instead, active and passive strategies can be combined to tap the strengths of each approach. Our Chief Investment Officer, Sanjoy Ghosh, has written about how active and passive investing both hold a place in Covestor’s investing philosophy.

Let’s revisit some of the ways that active and passive strategies can actually work together, and why there really might be no such thing as truly “passive” investing.

A PR nightmare?

First, some basic definitions.

Passive investing involves following market benchmarks such as the S&P 500 and is usually associated with index funds and ETFs. The idea is to simply to track or mirror the market.

Active investing typically involves a human portfolio manager using market timing, stock picking or other techniques in an effort to beat or outperform the market.

Passive index investing has surged in popularity in recent years. There are several reasons for this. Investors have focused more on fees, and index investing is associated with very low costs. Also, academic research has documented how difficult it is to beat the market over the long haul.

Active mutual fund managers have been dealt “a public relations thrashing,” writes John Rekenthaler, vice president of research at Morningstar.

“Index-fund managers have convinced the marketplace that the critical investment issue is whether to be passive or active,” he said. “The triumph of indexing has become a familiar tale … Active management is regarded as a losers’ game. That belief, however, is incomplete.”

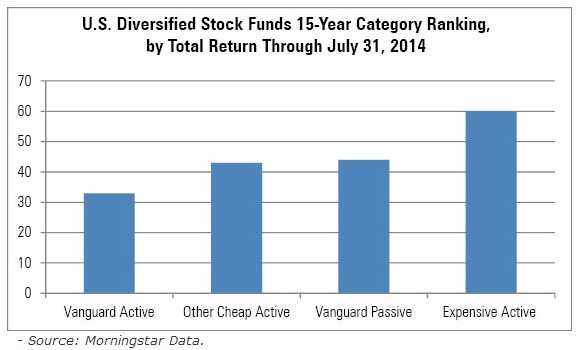

Rekenthaler, a long-time observer of the mutual-fund industry, notes that costs count more than active or passive. Low-cost investing is good investing, but not all low-cost investing is passive.

Heretics in the index temple

One interesting recent trend is that some asset managers known for their passive index portfolios are getting attention for their active strategies.

In fact, Rekenthaler finds that Vanguard’s low-cost actively managed funds have quietly outperformed their more-famous index siblings.

Also, the section of Vanguard’s website for financial advisors has a guest post on combining active and passive strategies in what are known as core-satellite models. The idea is to fuse the best parts of active and passive investing.

Building a better portfolio

BlackRock, which oversees a large family of index-tracking iShares ETFs, has also recently weighed in on how active and passive investing can be used together.

“While the debate between active and passive will never truly be settled, investors can sidestep the acrimony and embrace a simple approach that blends both to help build a better portfolio,” writes Russ Koesterich, global chief investment strategist for BlackRock, in the company’s blog.

“That of course leaves the question of how and when to combine active and passive.”

Koesterich says the right blend of index and active investments will depend on the investor’s specific risk tolerance and goals, but he offers five general factors to consider:

Active Funds

#1: Look for active funds with broad mandates.

#2: Consider active funds for asset classes that are difficult to represent with an index.

#3: Think of active funds as long-term, core holdings.

Passive Funds

#4: Consider passive funds when you’re trying to achieve precise exposure to certain asset classes in a cost effective and tax efficient manner.

#5: Think of passive funds for tactical exposure.

The bottom line is that active and passive investing shouldn’t be an “either-or” proposition. They can work together.

In fact, “passive investing” is probably a misnomer.

“[T]here is no such thing as a truly passive portfolio,” writes Cullen Roche at The Pragmatic Capitalism blog. “That is, the only ‘passive’ approach would be buying all of the world’s financial assets and simply taking the market return it generates every year. Of course, you can’t do this because no such product allows you to do this.”

Building a portfolio involves choosing which asset classes to invest in, such as stocks, bonds, real estate and cash. Investors also have to decide what percentage to devote to each asset class. Therefore, all investing involves a degree of “active” decisions, even if investors are using “passive” instruments such as index funds and ETFs to invest.

For some investors, the right mix of active and passive strategies could be the best solution.

Continue learning: Why active management is alive and kicking