This is the third installment of a multi-part series on the new breed of portfolio managers who are helping investors reach their financial goals on Covestor.

At Covestor’s investment marketplace, individuals can invest right alongside these managers and share their performance and expertise.

Today we’ll meet Clearbrook Capital Advisors, which manages the Undervalued Opportunities portfolio. Eric Steiman (pictured above) and Adam Friedman are the founders and managing members of Clearbrook, and together they have over 15 years of financial industry experience.

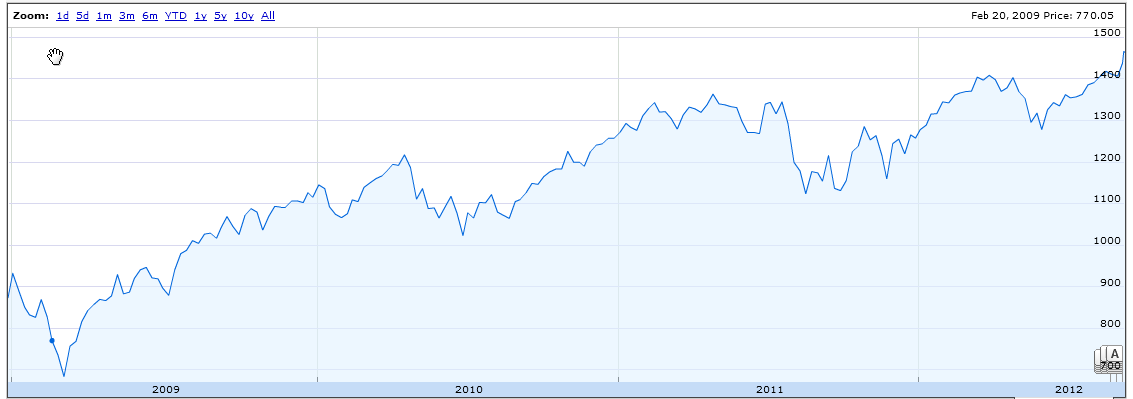

The portfolio has been on the platform since May 2011. It is off to a fast start during its first three years, with an annualized return of 52% net of fees since inception, as of Aug. 4. The S&P 500 is up 14.6% over the same period.

Below is an edited transcript of a recent interview with Clearbrook Capital Advisors:

Q: Why did you decide to manage a portfolio on Covestor’s marketplace?

A: Eric came to Covestor with an entrepreneurial background. He wanted to be a portfolio manager but didn’t want to take the “traditional” Wall Street route. He didn’t mind putting the time in, but wanted to do it in a more entrepreneurial way. Eric had traded for a few years and realized he was pretty good at it.

Q: How would you define Clearbrook’s style of investing?

A: In a nutshell, we’re always looking for the best risk-reward propositions on the long and short side. We tend to run a fairly concentrated investment strategy and we try to remain cognizant of where we may be in a particular market cycle.

On the long side there are some characteristics we look for when researching potential investments.

We like strong brands – businesses that we think have pricing power and strong management teams. We love founders who are still owners – and founders who are still running the company they created. Normally, when you have this arrangement, you know that management is aligned with shareholders.

We also look for “special situations.” This may be a situation where we think the sum of the parts may be worth more than market value of the entire company. Growth may be stagnant or management is trying to engineer a turnaround.

Additionally, we are always on the lookout for trades. An opportunity to take advantage of a shorter term pricing inefficiency. For example, we may see an opportunity when we disagree with the market’s reaction to a news event or an earnings announcement.

The amount we allocate to any category of investment is not fixed. It is always changing based on our assessment of overall market conditions and the availability of promising opportunities.

Q: Do you also short stocks?

A: We do short stocks, though we try to avoid shorting stocks based solely on valuation.

Shorting securities, especially market darlings based solely on valuation, can be dangerous. Market conditions are always changing and expensive stocks can become even more expensive. So, we try to find shorts where there is something additional that may give us an edge. For example, we may feel that management is over-hyping its business prospects and investors are still believing the hype.

Q: It seems like your strategy is very flexible.

A: Yes, we would say flexibility is extremely important. We don’t want to pigeonhole ourselves into a fixed strategy. We know what types of investments we seek, and depending on market conditions we want to be able to adjust our capital allocation weighting. We also want to be able to change our mind quickly in certain instances – we understand that there will be times when our initial evaluation proves incorrect. In these situations it is important to do our best to recognize the error and change course quickly if necessary.

For example, if you have a mandate that states you must always be 100% invested in stocks – it doesn’t give you much flexibility in a bear market. Bear markets will always occur and will happen again.

Q: The last few years after the financial crisis have been great for stocks. But how do you approach bear markets as investors?

A: Well, first we think it is important to understand that bear markets are part of investing. They will always occur. Human emotions drive the market and it is natural that the market will overshoot. When this occurs, then at some point a 20% plus drawdown is warranted to try to shake out the excess.

The one positive about bear markets is that they create opportunity for future investment ideas. Usually, some big pricing dislocations will occur and this will create a whole new set of potential investment opportunities.

Q: What are some of your thoughts on the current market environment?

A: There is definitely less low-hanging fruit on the long side then there was a couple of years ago. Capital is flowing into stocks and pushing prices higher. However, we think there are still opportunities here and there. Potentially, there may be some shorting opportunities in individual names. But, we will just have to wait and see.

Q: Can investment marketplaces help investors by giving them access to portfolio managers like you?

A: Absolutely. We offer an investment strategy that may or may not be a good fit for certain people, but they have an opportunity to decide for themselves. Covestor gives its clients an opportunity to participate in strategies that may not otherwise be available to them. An investment marketplace like Covestor may have some portfolios that will do well in different market environments, and provides a variety of different options to investors.

See Part 1 and Part 2 of this series.

To learn more about investing with the portfolio managers on Covestor, contact our Client Advisers at clientservices@interactiveadvisors.com or 1.866.825.3005. Or you can try Covestor’s services with a free trial account.

Disclaimer: All investments involve risk and various investment strategies will not always be profitable. Neither the information nor any opinions expressed constitutes investment advice and is not intended as an endorsement of any specific portfolio manager. Covestor has over 100 portfolios which can all be compared here. Past performance does not guarantee future results.