It has been called the most hated bull market in history.

Yet the rally lives on with the S&P 500 and Dow Jones Industrial Average climbing to new all-time highs.

They say markets like to climb a wall of worry. The economy isn’t exactly booming and it seems like there are many investors who still don’t trust stocks after the financial crisis.

Meanwhile, sentiment polls paint a mixed picture with the number of bullish investment newsletter writers at multiyear highs, while individual investor sentiment is much more subdued.

So it has been more difficult for individual investors to heal the psychological scars from the credit crisis. More than five years later, there are still flashbacks that unnerve investors.

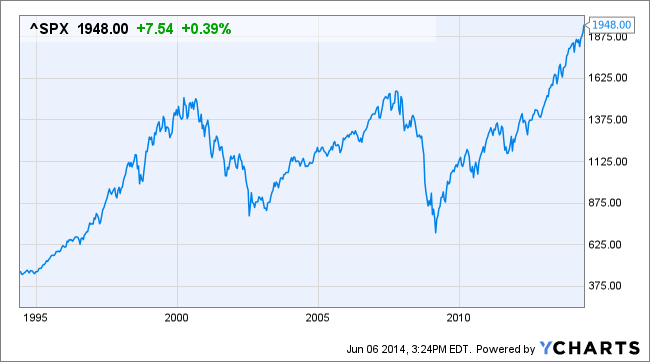

Despite an 180% gain over the past five years in S&P 500 from the market lows set back in March 2009, individual investors remain surprisingly wary of stocks, according to Bankrate’s monthly Financial Security Index.

S&P 500

That’s remarkable given the ultra-low interest rate environment and lower returns for fixed income securities, certificates of deposit and savings accounts. In the survey by Bankrate.com, fully 73% of respondents say they’re no more inclined to put capital to work in equities than they were a year ago.

“The psychological impact of 2008-2009 is persisting much longer than in prior recessionary cycles,” Tim Leach, chief investment officer at U.S. Bank Wealth Management, told the Wall Street Journal recently.

The allergy to risk is particularly keen among Millennials – investors born after 1980 – who have seen their work and professional lives disrupted by the Great Recession and subsequent years of uneven growth and tight labor markets.

This age group is about as fiscally conservative as the World War II generation, according to a 2014 study conducted by the investment bank UBS. The parallel is an interesting one: Americans 68 and older grew up in families that were influenced by the Great Depression, UBS notes.

“This is remarkable given the impact the Great Depression had on the WWII generation and speaks to the potential permanent scarring that 2008 had on the Millennial investor,” UBS said in the research note.

All this matters because Millennials, who represent about 27% of the adult U.S. population, hold 52% of their assets in cash, and only 28% in equities, on average, according to UBS.

It’s hard to see the aversion by investors toward stocks turning around anytime soon, especially since the current bull market that began in March of 2009 is getting long in the tooth. Some market pros see trouble ahead.

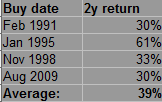

In an early April note to clients, Jim Paulsen of Wells Capital Management argued the current bull market has some similarities to the five-year bull market that began in 1982. That market surge collapsed in 1987 with the S&P 500 suffering its biggest single-day percentage loss ever.

Paulsen is not sure we will see an exact replay of the 1987 crash, but thinks a 10% correction is a possibility. That isn’t the sort of market scenario that will attract young risk takers into stocks.

How does this bull market stack up against others in history? As of May 15, the magnitude and duration of the current post-financial crisis rally is greater than six and less than six Dow rallies since 1900.

On the other hand, anecdotal evidence and sentiment data suggest when it comes to individual investors, we aren’t even close to “irrational exuberance.”

For more on Covestor’s services, visit Covestor.com or try a free trial.

DISCLAIMER: The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. All investments involve risk, the amount of which may vary significantly. Past performance is no guarantee of future results.