The S&P 500 is up nearly 30% so far in 2013 and on track for its best year in a decade.

Is this really the most hated bull market in history? Not even the government shutdown or worries the U.S. could default on its obligations have stopped the market in 2013. The S&P 500 continues to set new record highs.

“The market confounds everyone and keeps going up,” said Tom Dorsey, co-founder and president of Dorsey, Wright & Associates, in a recent webcast hosted by Covestor. “The market loves to climb a wall of worry.”

S&P 500

Negative news on government gridlock and the economy had some investors hiding out in cash this year, but they need a rules-based approach to protect against being taken over by emotions, said Dorsey. His firm, which manages the Global Technical Leaders portfolio on Covestor, focuses on technical analysis. The investment philosophy focuses on point and figure charting, and relative strength.

The approach tries to filter out the noise of daily price fluctuations to identify stocks, sectors and asset classes that are exhibiting momentum opportunities. The strategy also forms the basis for several index-based ETFs: PowerShares DWA Momentum Portfolio (PDP), PowerShares DWA SmallCap Momentum Portfolio (DWAS), PowerShares DWA Emerging Markets Momentum Portfolio (PIE) and PowerShares DWA Emerging Markets Momentum Portfolio (PIZ). The ETFs hold combined assets of more than $2 billion and the benchmarks rebalance on a quarterly basis.

Dorsey said that U.S. stocks are in the third year of a structural bull market that began after the end of the structural bear market, which was punctuated by the twin declines of the dot-com crash and financial crisis.

He said no one knows how long the current bull market will last. Since 1896, the Dow Jones Industrial Average has gone through four structural bull markets, ranging in duration from 6 to 20 years.

“I don’t feel great about the economy,” Dorsey said. “I do feel good about the stock market.”

Those seemingly divergent views reflect Dorsey’s preference for technical rather than fundamental analysis. His firm concentrates on supply and demand forces in the market, as well as accumulation and distribution patterns in stocks. This research can reveal securities or entire sectors moving from “weak” to “strong” hands, or vice versa.

Dorsey, Wright uses relative strength measurements to pinpoint stocks and sectors that are outperforming the market, and combines them with point and figure charting to develop a ranking system. The firm will sell when it sees signs of weakness, and looks for the next outperforming asset to invest in.

Dorsey classified the approach as a long-term trend-following strategy that attempts to participate in the middle of a trend rather than trying to time tops or bottoms. In other words, the tactic is designed to ride momentum.

“We’ve built a rules-based system that removes human intervention and emotions. There is no human DNA on the accounts,” he said.

Dorsey, Wright manages the Global Technical Leaders Portfolio on Covestor which invests in the PowerShares DWA Momentum ETFs and can also hold cash through money market funds. The strategy ranks the four ETFs on a relative strength basis and any funds ranked above cash will be purchased in the portfolio.

The top-ranked ETF will receive a 50% allocation, and the remaining 50% will be divided equally to all the funds ranked higher than money markets. If money market occupies the second ranked spot, from a relative strength perspective, then 50% goes to the money market and the remaining 50% goes to the top ranked ETF. Alternatively, when stocks are not in favor and money market outranks all of the four ETFs, the model can go to 100% cash.

The portfolio currently has about 50% in PowerShares DWA SmallCap Momentum Portfolio (DWAS) and roughly 16.6% each in PowerShares DWA Momentum Portfolio (PDP), PowerShares DWA Emerging Markets Momentum Portfolio (PIE) and PowerShares DWA Emerging Markets Momentum Portfolio (PIZ).

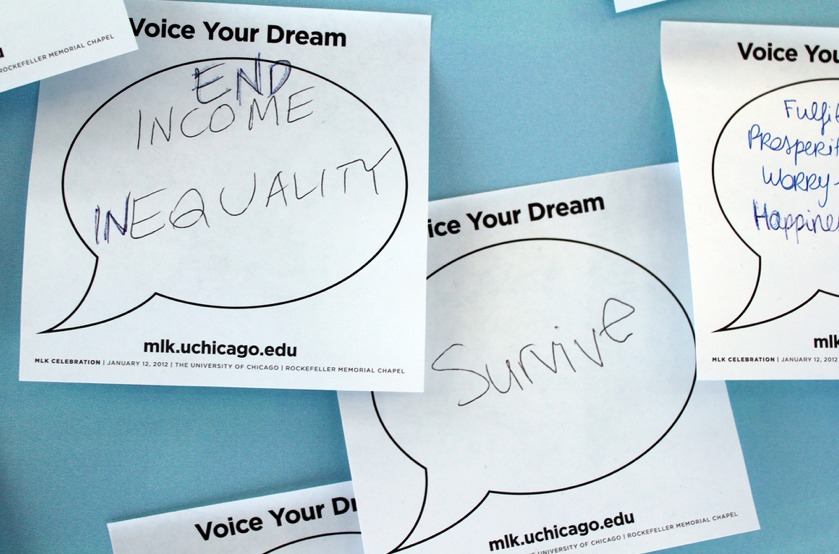

Photo Credit: David Paul Ohmer

DISCLAIMER: The investments discussed are held in client accounts as of September 30, 2013. These investments may or may not be currently held in client accounts. The opinions and views expressed herein are of the portfolio manager and may differ from other managers, or the firm as a whole. The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. The S&P 500 is an index of 500 stocks chosen for market size, liquidity and industry, among other factors. Investors cannot invest directly in an index. Indexes have no fees. Past performance does not guarantee future results.