U.S. companies have been buying back shares at a rapid clip in 2013 and Core International Portfolio manager Martin Leclerc expects the trend to continue next year.

Shares bought under company repurchase programs accounted for more than 6% of daily trading in the Russell 3000, a benchmark for the broader U.S. stock market, Bloomberg News reports.

According to a recent report from Goldman Sachs, S&P 500 firms are buying back over 3% of their market cap, or about twice the pace from the 1990s. About 80% of S&P 500 companies are buying back shares.

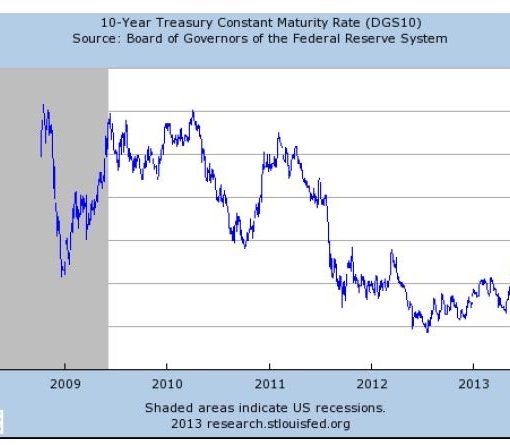

“Strong corporate balance sheets, low bond yields, and low U.S. economic growth has meant that investors want companies to return more cash to shareholders via buybacks and dividends,” according to Goldman economist Stuart Kaiser.

Companies still have a lot of cash, and Leclerc expects more buybacks in 2014. He told Bloomberg:

“The mathematics are pretty compelling,” Martin Leclerc, founder of Barrack Yard Advisors LLC and a 30-year veteran of investment management, said in a telephone interview Dec. 11. His firm oversees $260 million. “There will be continued shareholder buybacks, even increased shareholder buybacks, because things are pretty good.”