I’ve been investing professionally for 20 years. For most of that time, I’ve been focused on technology companies. As you might imagine, it’s been a wild ride.

After six years as a computer programmer, I finished my MBA in 1993, just in time for the Internet and World Wide Web to be commercialized. Yee hah! Cell phones, modems and Dell, oh my! Fifteen years as an analyst and mutual fund manager; then I started my own firm in 2008, where I’ve been running a tech-focused investment portfolio, which is also available on Covestor.

Meanwhile, whole TV shows (e.g., Bloomberg West), web sites (e.g., Barron’s Tech Trader, Silicon Alley Insider) and blogs (too many to mention) are dedicated to the intersection of Wall Street and Tech. It’s received wisdom that tech is at the forefront of Wall Street leadership.

But this year I’ve been given reason to doubt this primacy. Since April, three different people have told me I have the “wrong product.” All three people who gave me this advice are very experienced in money management and have widely varying perspectives. But each, independently, questioned whether a long-only, equity-only tech fund is still of interest.

Each had suggestions. One said I should create a long-shortversion (i.e., a hedge fund) of my model, using the same quantitative process I currently use. Another suggested perhaps a mutual fund that permitted shorting (i.e., again, a hedge fund). The third pointed out that since I’m squarely in Morningstar’s Small-Cap Growth box, I should therefore re-brand what I’m already doing as “Small-Cap Growth.”

Nobody’s really looking for a long-only tech product anymore, the three wise men said.

I haven’t much liked hearing this, so I did some research. And…tech has definitely lost some pep in its step. For example, in 1999 when the S&P 500 Index rose 19.5%, the most widely held Tech ETF, the Technology Select Sector SPDR (XLK), rose 65.2% for the year. And in the post-dot-com bubble recovery year of 2003, the S&P was up over 26%, lagging the XLK’s nearly 39% performance.

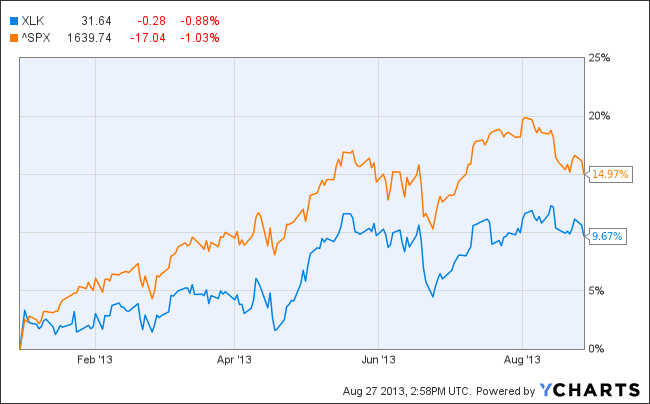

In 2013? The S&P is up 15% as of August 26 while the XLK is up just 9.7%. In fact, year-to-date, every other major sector ETF is out-performing the XLK, with the exception of the Materials-focused (XLB).

Yikes.

OK, overall performance is down. But isn’t there still plenty of institutional interest in tech? According to Lipper, there are 40 tech-focused mutual funds (after eliminating multiple share classes), managing a total of $25 billion. This may seem like a lot, but in 2002, when I became lead manager of $200 million technology-based mutual fund, there were 170 funds just like mine. Since then, it’s been a drip-drip-drip of asset runoff and tech fund consolidation and closure. And $25 billion is basically a rounding error to your average boldface-named hedge fund manager.

But wait just a minute. As of early August, tech was the single biggest sector in the S&P 500 Index, making up 17.8% of it. So tech, despite its fading glory, is still very much part of Wall Street. How then, do we reconcile these differing perspectives? One way, of course, is to acknowledge the rise of hedge funds over the past 20 years. There’s no doubt a lot of assets-under-management that might previously been the province of mutual funds is now in the hands of hedge funds. And hedge fund interest in tech has certainly remained strong. After all, think of all the current or former investors in SAC Capital’s orbit who are either in jail or perhaps headed there shortly, all in the service of knowing Dell’s earnings before mere mortals like us.

So we’re back to that question: how can tech still be so big – in our minds and in the media – and be so bad that short selling opportunities seem as fruitful as long ones?

Perhaps the answer isn’t that ‘tech is over.’ Perhaps it’s because what the world thinks of as ‘tech’ isn’t very ‘tech’ anymore. Consider that the top 10 holdings in the XLK are (with their size in parentheses) Apple (14.2%), Microsoft (7.8%), Google (7.8%), IBM (6.4%), AT&T (6.2%), Verizon (4.7%), Cisco (4.5%), Oracle (3.9%), Qualcomm (3.7%) and Intel (3.1%).

Apple’s last major product release (the iPad) was over three years ago. Microsoft and Intel are in the Dow Jones Industrial average for good reason: they’re industrial suppliers. Phone companies??? Except for Google, none of these war horses currently has a business model built on innovation. And their stock prices have reflected it this year.

Why isn’t Priceline in the XLK? Or Facebook? LinkedIn? For that matter, where is Hexcel, leading the way in aerospace composites? Or Sealed Air, commercializing completely biodegradable packaging material made from mushrooms?

Tech ETFs may be under-performing, but that’s an ETF problem, not a tech problem. Tech isn’t going away, because innovation isn’t going away. It’s time for investors to realize that if you want what technology companies can offer – higher growth, higher profit margins and (possibly) higher returns – don’t expect to find them in an ETF.

Photo Credit: magerleagues

The investments discussed are held in client accounts as of July 31, 2013. These investments may or may not be currently held in client accounts. The S&P 500 is an index of 500 stocks chosen for market size, liquidity and industry, among other factors. Investors cannot invest directly in an index. Indexes have no fees. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.