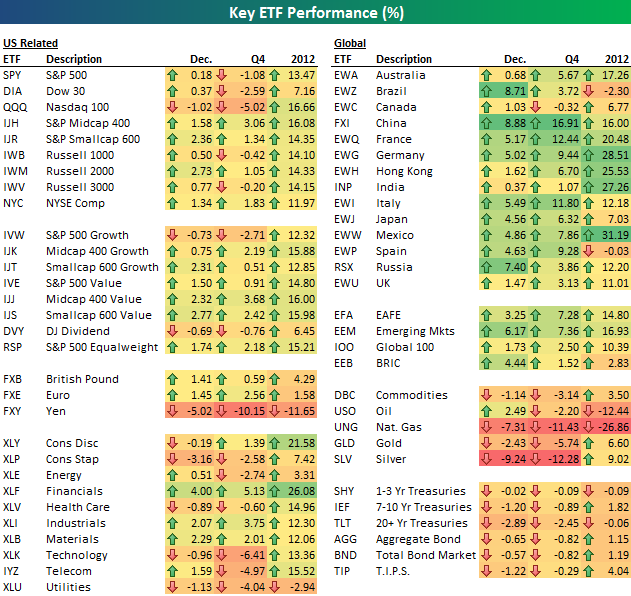

Below is a look at the final 2012 performance numbers for key ETFs across all asset classes. We also include how each ETF performed in December and in the fourth quarter. Click to enlarge:

As shown, US equity indices did well in 2012, but international markets did even better. France (EWQ), Germany (EWG), Hong Kong (EWH), India (INP) and Mexico (EWW) were all up more than 20% for the year. Mexico (EWW) was the best performing ETF in the entire matrix with a 2012 gain of 31.19%. Germany (EWG) was the second best performer at +28.51%.

In the US, the Nasdaq 100 (QQQ) and S&P Midcap 400 (IJH) were the best performing index ETFs in 2012 with gains of more than 16%. The Financials ETF (XLF) was the best performing sector ETF with a gain of 26.08%, followed by Consumer Discretionary (XLY) at +21.58%. The Utilities sector (XLU) did the worst and actually declined 2.94% for the year.

Looking at commodities, oil (USO) was down double digits in 2012 with a decline of 12.44%, while gold (GLD) and silver (SLV) posted gains of 6.60% and 9.02%, respectively. Finally, fixed income was down across the board in December and the fourth quarter, but the aggregate bond market ETF (AGG) managed to post a small gain for the full year. The 20+ year Treasury ETF (TLT) ended down for the year after a rough month of December.

Data and table: Bespoke Investment Group

Some ETFs mentioned in this post are held in client accounts as of December 29, 2012. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.