by Michael Tarsala, CMT

The July jobs report was not great but better than expected, sending stocks near levels not seen since early May.

Nonfarm payrolls rose by 163,000 in July, the fastest pace in four months.

Perhaps the economy is treading water. It’s not great, but it’s not eroding overnight.

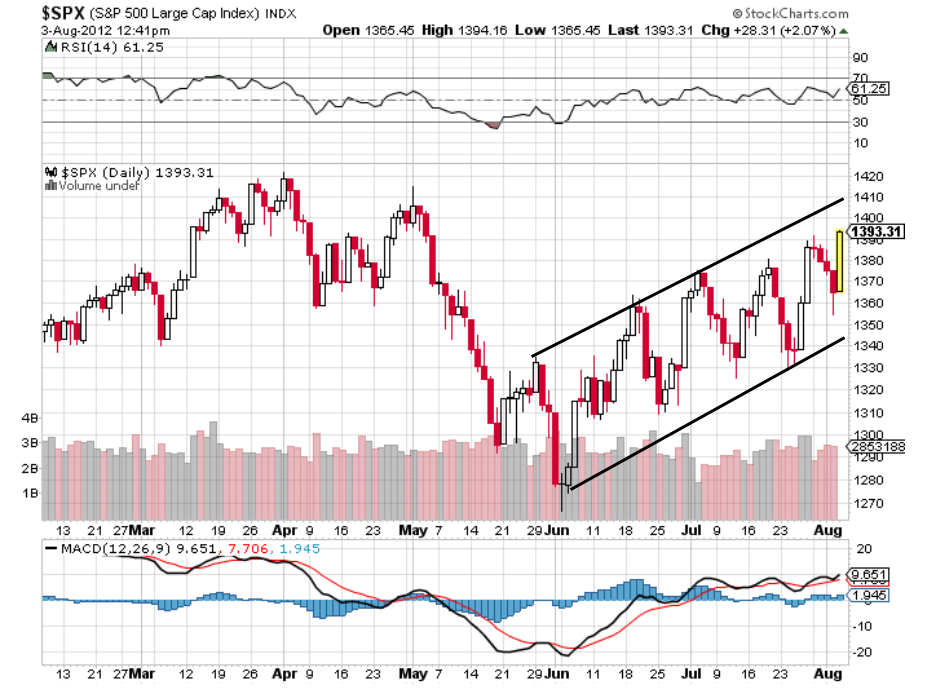

I’ve mentioned this before. It is a positive that the S&P 500 and the Dow Industrials continue a series of higher highs and higher lows within a tight channel.

September is typically the roughest markets month. Still, there is a case to be made for a rally, as we approach what is usually a seasonally strong period in election years.

Source: Stockcharts.com

The S&P 500 chart above shows a strong, steady uptrend for now, with markets showing few signs of being technically overbought.

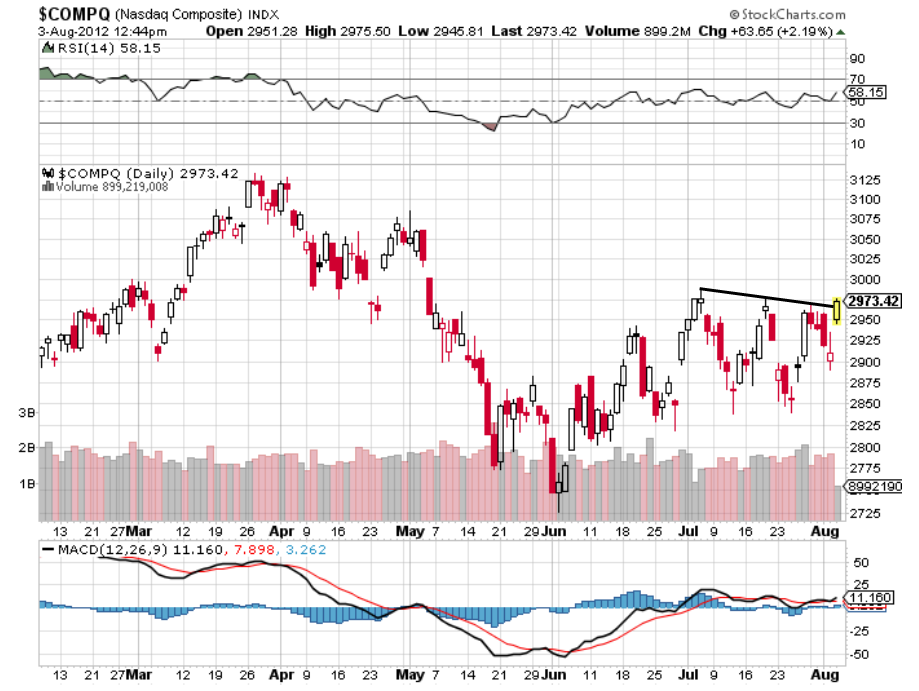

Yet the NASDAQ Composite is still throwing off a cautionary signal. It has made a series of lower highs since early July.

Source: Stockcharts.com

That’s not great. You ideally want to see all three indices doing the same thing to confirm a trend.

This is why today’s “OK” jobs report is important: The Nasdaq’s lower-highs trend likely will be broken with Friday’s close.

It’s still not an all-clear signal. The Nasdaq still has to get past the July highs – like the S&P and the Dow already have – to confirm the overall uptrend.

We’re getting awfully close.