At the start of the year, many thought the seven-year bull market rally might end. Not so it turned out.

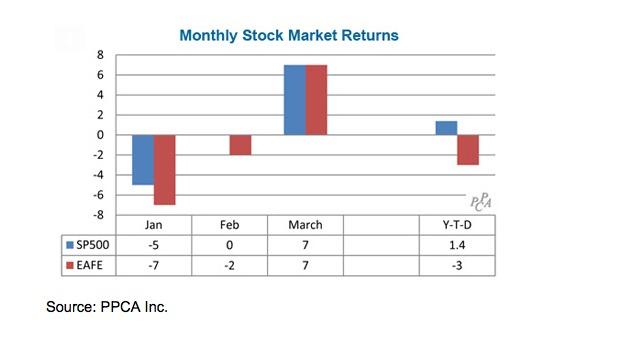

Stock market investors breathed a sigh of relief as January losses were more than recovered by the end of March.

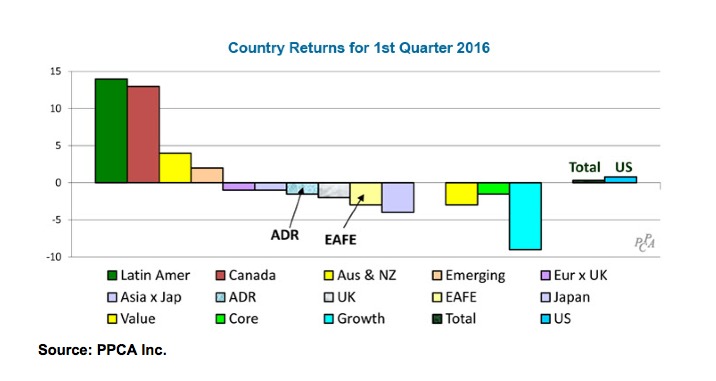

U.S. stocks earned 1.4% in the quarter, although foreign markets declined 3% as measured by the MSCI EAFEIndex.

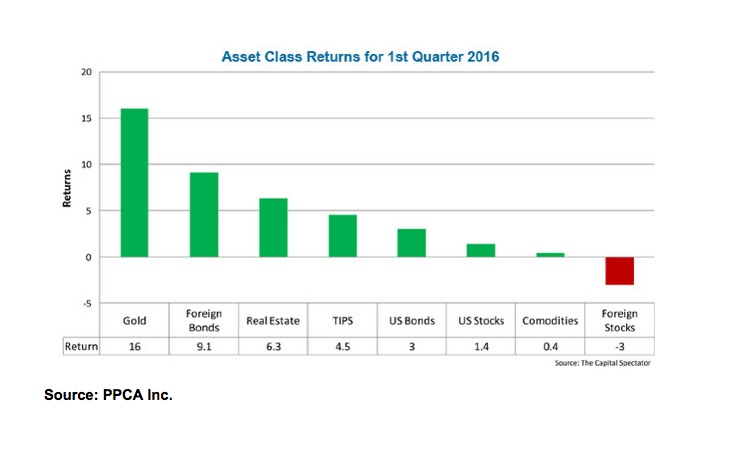

Diversification Works

It would seem that the scare is over. Nevertheless, I’m sticking with my forecast for a 19% loss in the US stock market this year.

Interestingly, diversification worked in the first quarter, with gold, foreign bonds and real estate performing quite well, much better than stocks.

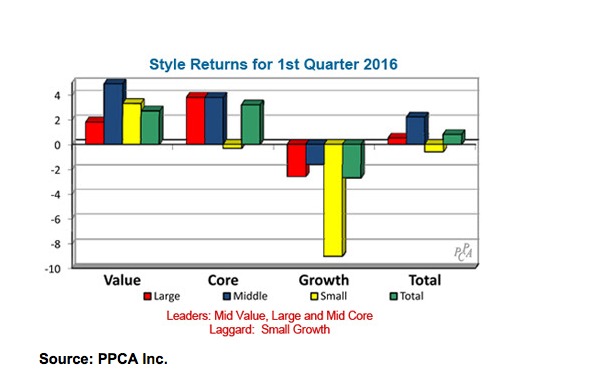

Tough Market

In the following section we report on the details of U.S. and foreign stock market performance.

As you’ll see, most market segments came through okay, but some disappointed. It’s been challenging.

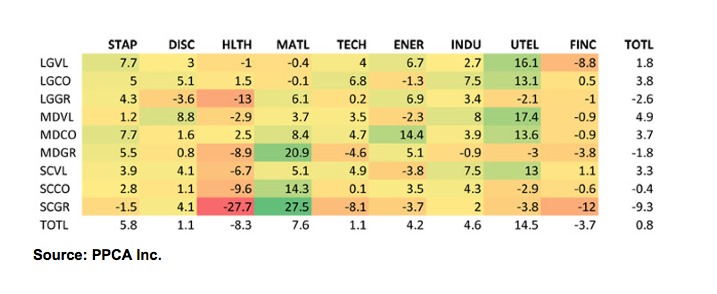

The stuff in the middle performed best in the quarter with mid-cap outperforming large- and small-cap, and core outperforming value and growth.

Small Caps

Style performance ranged from a high of 4% for large-cap value to a low of -9% for small-cap growth.

Small growth companies are very risky. The total market returned 0.8%, a little less than the S&P 500’s 1.3% gain.

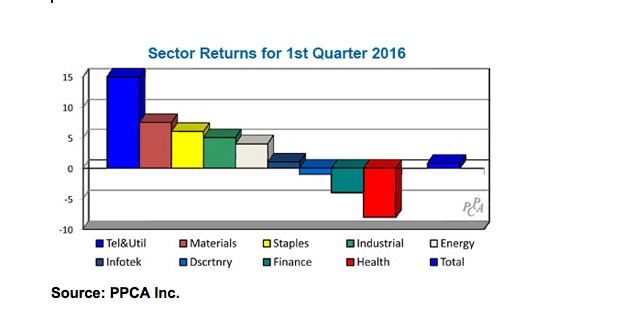

Energy Prices

The performance range across sectors was even larger. Telephone and utility companies earned a substantial 15% return, while healthcare firms lost 8%. That’s a 23% spread.

Energy prices rebounded in March, so energy stocks enjoyed a positive 4% return for the quarter.

Drilling deeper into U.S. market segments, the following heat map shows performance within style-sector cross-sections.

We can see that small-cap growth material stocks performed best with a 27.5% return, while small-cap growth healthcare stocks lost the most, with an equal-and-opposite 27.7% loss.

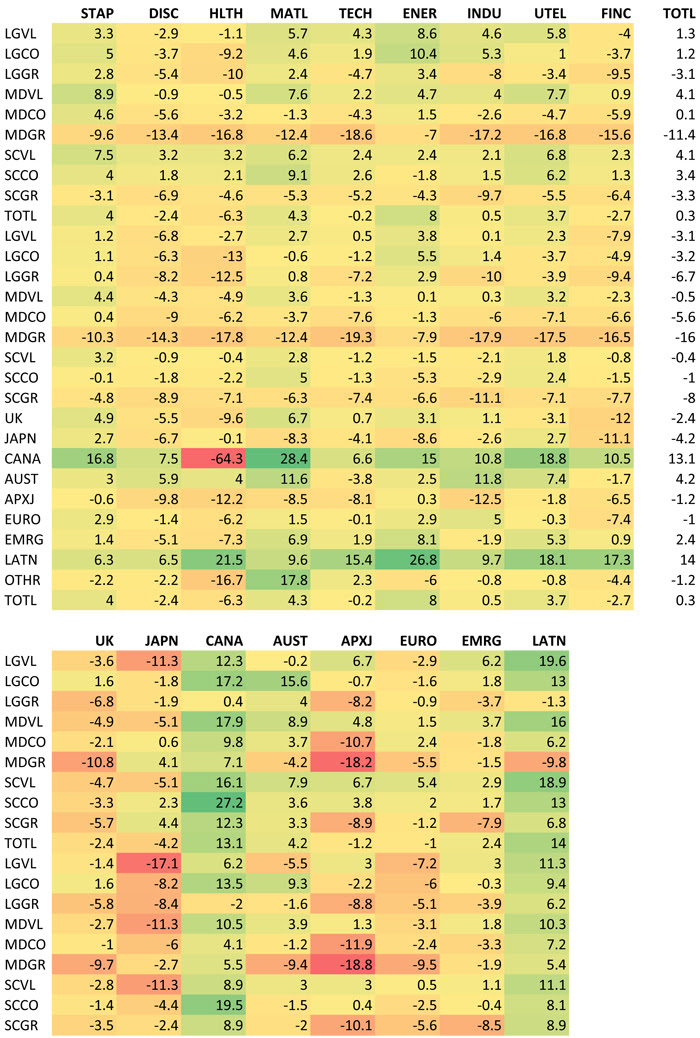

Looking outside the U.S., Latin America and Canada left the rest of the world in their dust, earning double-digit returns of 14%, while the next best country earned only 4% and the U.S. was flat.

From a global perspective EAFE was easy to beat because it has no allocation to Canada and Latin America.

Looking in more detail, Canada and Latin America were strong in every segment except Canadian healthcare, losing 64%, the worst performing segment in the world.

The best performing segment was Canadian materials with a 28.4% return.

Aging Bull

After seven years of extraordinary growth, stock markets are showing signs of weakening.

No one knows what lies ahead, but we all have outlooks on the economy and the stock market, and adjust our thinking as results roll in.

I personally remain surprised and grateful that stocks have performed so well in the past 7 years, following the 2008-2009 meltdown. It’s been a long-term reversal.

Photo Credit: Zooey via Flickr Creative Commons