Author: Charles Sizemore

Author: Charles Sizemore

Covestor models: Dividend Growth, Strategic Growth Allocation, Sizemore Investment Letter, Tactical ETF

Disclosure: Long TKC

As I write this article, 670 million people are without electricity in India.

Stop and think about that for a minute. That is nearly double the population of the United States, and none of them have had electricity for the better part of two days. Some homes and businesses have backup generators, but the vast majority of those affected were quite literally left in the dark.

Needless to say, business productivity has ground to a halt.

In a seemingly unrelated story, Turkish mobile telecom giant Turkcell (TKC) released second quarter results week that sent shares up sharply, even while the company hasn’t paid a dividend in over two years due to a boardroom dispute that could pass for an episode of the Jerry Springer Show.

Turkcell’s board is so bitterly divided that they can’t even properly schedule a shareholder meeting, and the Turkish state is threatening to intervene to break a legal deadlock that has involved courtrooms on three continents. At one point, it was even being debated by Queen Elizabeth II’s Privy Council.

This isn’t a third-world, basket-case company. Turkcell is one of the most respected mobile carriers in the world and routinely wins awards in Europe for its service quality. And yet a boardroom circus like this can happen even at Turkcell.

Why do I bring up these two stories? Because they illustrate both the risks and opportunities presented to investors by emerging markets.

Emerging markets are, by definition, not fully established. They’re still a little rough around the edges and, frankly, investors should expect setbacks along the way. The added risk is the price you pay for the expectation of higher returns.

Emerging market equities have not performed well in 2012, as slower growth in China, India, and Brazil have sapped investor enthusiasm. The iShares MSCI Emerging Markets ETF (EEM), which many use as a proxy for emerging markets in general, is down 16% over the past 12 months.

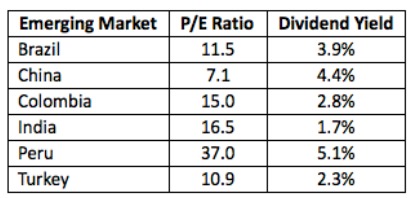

Source: Financial Times

Looking at a sample of emerging market indexes, we see significant differences in prices. Chinese shares, at seven times earnings, are almost shockingly cheap, and Brazil and Turkey are priced attractively as well at 11.5 and 10.9 times earnings, respectively.

At the other end of the spectrum, Peru is trading at levels reminiscent of the 1990s tech bubble at 37 times earnings, and Colombia and India are comparatively expensive (at least relative to China, Brazil and Turkey) at 15.0 and 16.5 times earnings.

A summary comparison of emerging market stock prices doesn’t constitute a comprehensive analysis, but one point is clear. Outside of a few outliers, emerging market equities are cheap relative to their prices of recent years and relative to developed markets. Investors, by and large, have fallen out of love with them as an asset class.

Barring a destabilizing meltdown in the euro zone, I expect to see emerging market equities finish 2012 strongly. The time to buy them is when they are cheap and unloved — as they certainly are today.