The race is not always to the swift, nor the battle to the strong, but that’s the way to bet–Damon Runyon

Here are a few predictions for 2017:

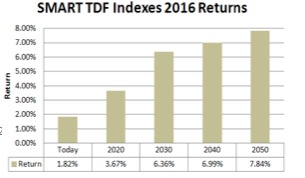

I believe there will be a major breakthrough in target date funds that will revolutionize the entire defined-contribution pension industry. Expect an announcement in March, or sooner.

Despite consensus forecasts to the contrary, in my opinion, stock and bond markets will lose value. This is a rare event. Going back to 1926, stocks and bonds have only had simultaneous calendar year losses three times — 1931, 1941 and 1969.

Because I think 2017 will disappoint, protective strategies will gain assets as investors “close the barn door” in my opinion. I believe hedge funds and portfolio insurance will benefit.

Investor Stampede

I think recent reversals will continue into 2017. Specifically, commodities and energy will fare well while health care will struggle. On the country front, Canada and Emerging Markets will do well.

I also think smaller value stocks will underperform as investors realize that the lemming stampede to “smart beta” has created a greater fool valuation bubble. Smart beta will not “work,” in my view.

Eight-Peat

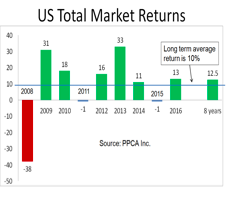

With the exceptions of a couple slight stumbles in 2011 and 2015, the 2008 market correction has been followed by consistent market gains, with 2016 delivering a 13% total market return.

It’s been an eight-peat: eight straight years of solid market gains.

American Bull

The U.S. stock market has returned a compound 12.5% per year over the past 8 years, well exceeding the market’s 10% per year average.

On a cumulative basis, the US stock market has grown more than 150%.

But folding in 2008’s 38% loss leaves us with a 60% 9-year cumulative return, or 5% per year, well below the market’s 10% average.

Long Game

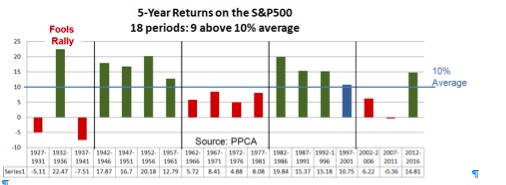

Some look at the past 8 years and say we’re due for a correction while others look at the past 9 years and say we still have more ground to make up.

In both cases, the time frame is too short to make a meaningful guess, so we’ve examined the entire 90-year history of the US stock market, looking for patterns in 5-year returns.

Here are a couple observations:

There appears to be a pattern in stock prices that oscillates on a 20-year schedule – above average for 20 years, then below average. If this pattern is currently repeating, we are in a 20-year down period that has been interrupted in the past 5 years.

Fools Rally

In my opinion, we could be repeating the “Fools Rally” of 1932-1936, when the market temporarily rebounded from the Great Depression, only to be slapped down hard again in the subsequent 5 years.

What do your eyes tell you?

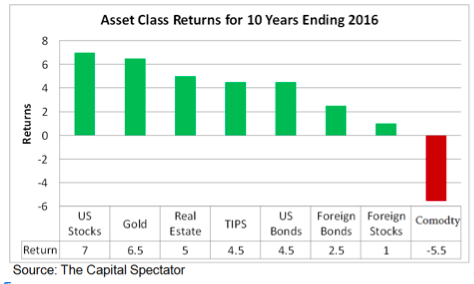

In the next sections we look at diversifying asset class performance in 2016 and the past 10 years, and then examine US and foreign stock markets performance in detail.

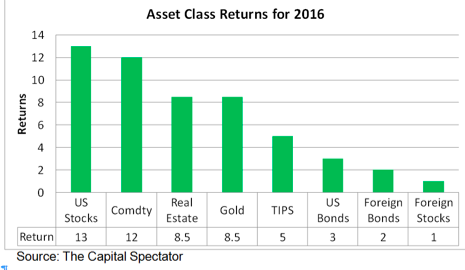

The US stock market performed best in 2016, as shown in the graph below. As is usually the case, there is a wide dispersion of performance in 2016 amongmulti-asset portfolios caused by offsetting diversification effects.

Gold

Diversification into commodities, gold and real estate helped performance, but diversification into foreign stocks and bonds hurt, due in part to the 3.6% strengthening of the US dollar.

All the bars in the exhibit are green, indicating that all asset classes earned positive returns in 2016. This fact will increase correlation approximations, reducing the estimated benefits of diversification going forward.

Long Lens

Looking back over the past 10 years, we see that the U.S. stock market maintains its leadership, despite its 38% loss in 2008. It’s literally been “better than gold.”

By contrast, commodities have been slammed. Relative to this longer term perspective, the 2016 picture shows momentum is in U.S. stocks and a reversal in commodities.

In the following we examine the performance of US and foreign markets in 2016 and the past ten years.

U.S. stocks

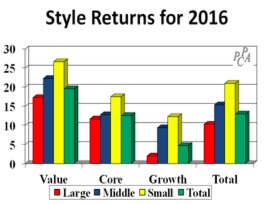

Small-cap stocks led the way in 2016, with small-cap value stocks performing best, earning 27%.

By contrast, large-cap growth companies earned only 2%. I useSurz Style Pure® classifications throughout this commentary.

Much of the recent success in smaller company value stocks can be attributed to the popularity of “smart beta” that tilts toward smaller companies and value.

Smart beta strategies have attracted more than$500 billion, which is about 20% of all US exchange -traded product as of the end of 2015.

Note that the S&P 500 returned 12% (not shown), which is less the total market’s 13% return because smaller companies were in favor.

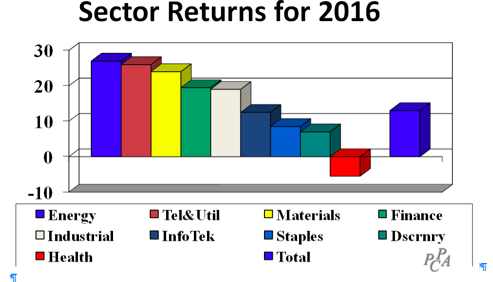

Energy Rules

On the sector front, energy stocks fared best, earning 27%, marking a significant reversal (see discussion below on 10-year results). By contrast, healthcare stocks lost 5%, also a reversal.

Looking back over the past 10 years we see that mid-cap value stocks have performed best with a 9% per year return, while small cap growth stocks have lagged with a 3% return.

Opposing other style index providers, value stocks by our definition have outperformed growth stocks.

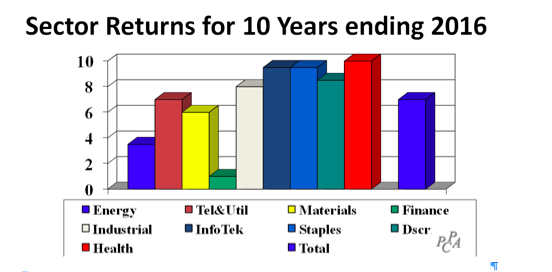

Turning attention to sector performance for the decade, returns in the following chart are shown in the same sequence as the year, so you can see that the big changes in 2016 are reversals in energy and health care.

Energy stocks had been underperforming prior to 2016 while health care had been outperforming.

On the style front, value stocks performed best with a 16% return while growth stocks lost 2.5%.

On the style front, value stocks returned 9% while growth stocks earned only 2.5%. Value stocks have been in favor around the world.

Foreign Stocks

Looking outside the U.S., foreign markets earned 6.5%% in 2016, lagging the U.S. stock market’s 13% return, but exceeding EAFE’s 1.5% return.

Japan and Europe were laggards in 2016, earning 6% and 1.5% respectively, and these countries are the major components of EAFE.

Looking back over the past 10 years, foreign market returns of 5% per year have lagged the U.S. with a 7% return but far exceeded EAFE at 1.2%.

Like the U.S., there was a reversal in 2016 – Canada had been underperforming.

Photo Credit: Todd Sternisha via Flickr Creative Commons