by Michael Tarsala, CMT

The S&P 500 suffered a miserable technical failure on Monday.

It failed to clear price threshholds that would have signaled an end to the downtrend.

Source: Stockcharts.com

So much for a Spanish fiesta. The markets quickly ferreted out that the Spanish bank bailout did not address systemic European problems.

Prices were attracted back to the strong volume area marked by the longest black bars. Those bars acted as a price magnet in recent days, and were a key level for the markets to clear to the upside.

We failed at those levels on Monday, though. Those long black “magnet” bars are now price resistance.

The very last candle, in red, nearly engulfs the prior one, based on the opening and closing prices. The last time we saw a full “engulfing” pattern was late May, also is circled on the chart. It was a precursor to a 3.8% peak-to-trough drop for the market.

We failed to close above the late-May lows at 1344, of course. And we now might not even challenge the next major retracement level, up around 1360 to 1365.

Volatility rose.

What’s arguably worse, defensive stocks continued to rise.

Source: Stockcharts.com

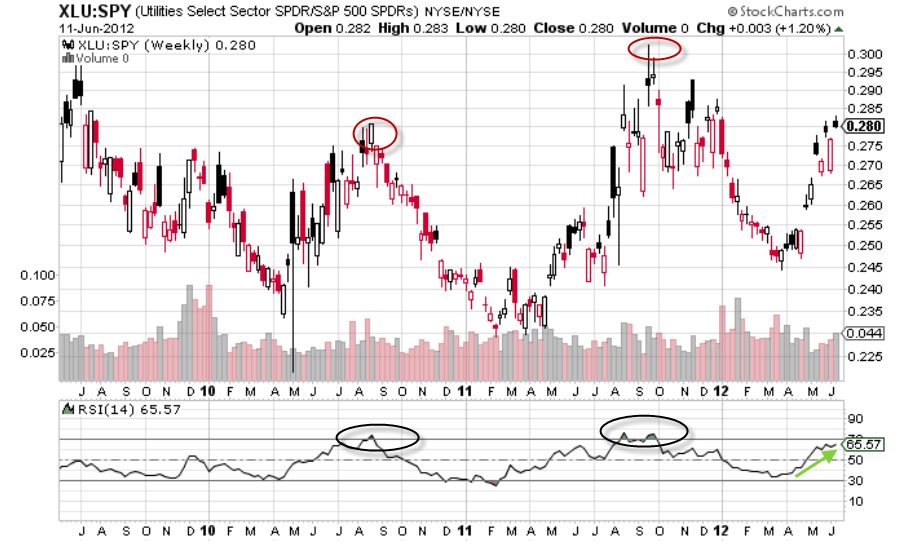

One of the risk-on, risk-off signals we’ve been watching is the performance of defensive stocks — especially utilities — relative to the rest of the market. This chart shows the Utilities Select SPDR (XLU) relative to the S&P 500 SPDR (SPY).

The underperformance of utilities helped to mark bottoms for the S&P 500 both in the summer of 2010 and early fall 2011.

That has yet to happen this time around.

Until then, it very well may remain a risk-off market.

Some strategies that you might want to consider to avoid big losses include:

— Holding stocks with a lower volatility than the overall market, which is being done by managers including Bill DeShurko, who runs the Dividend and Income Plus model. He says there is not a stock in his portfolio with a beta higher than the overall market.

— If it’s right for you (it is rated a riskier model), swing-trading models can aggressively position for short-term market moves, perhaps in a small portion of your portfolio. Mike Arold’s Technical Swing model still has a performance chart that is up and to the right.

— Also if it’s right for you given your risk tolerance, there are about 15 different long-short models on the Covestor platform, including Dan Plettner’s Long-Short Opportunistic model.