by Michael Tarsala, CMT

About a week ago, I said that there were two signals that would suggest the market is back in rally mode — a decline in market volatility and underperformance of utilities stocks, one of the market’s most defensive sectors.

One of those factors — volatility — is now on the decline. The charts provided a nice heads up to the near-term reversal.

Source: Stockcharts.com

Market volatility is represented by the black and white candles. The S&P 500 is just behind the VIX, marked by the line in black.

The volatility trading on Monday, circled above, was an important day. The long “wick” on the candle that day shows that the VIX saw a big rally that was cut short by Monday’s close. It was a failure for those trading market volatility higher to continue to push it upward. That was one important cue — along with the overbought extreme marked by RSI at the top of the chart — that the volatility rally would be cut short, at least in the short term.

We also had been watching cues provided by the currency markets that risker sectors including energy and materials could see near-term upside.

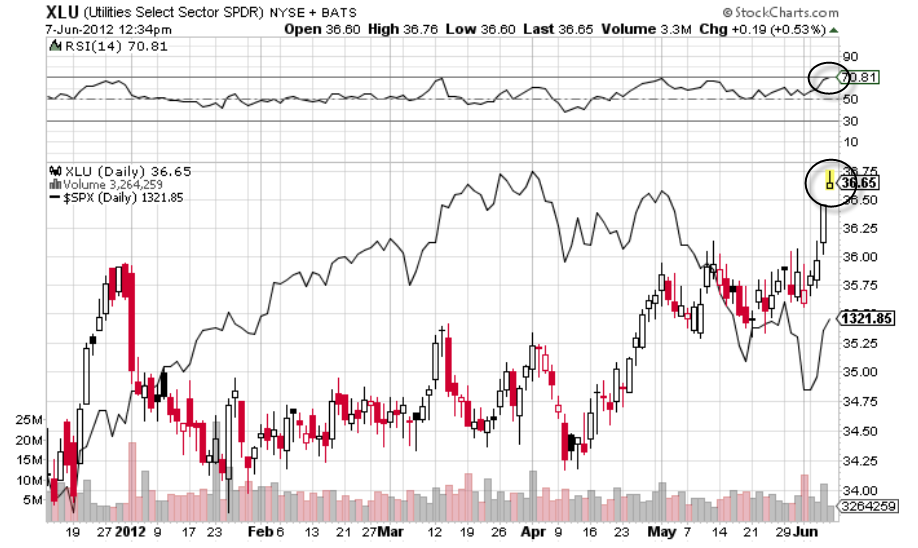

Now let’s take a look at utilities:

Source: Stockcharts.com

Utilities have yet to really underperform in a big way.

Yet does the circled candle look familiar? Just like with the VIX on Monday, utilities are showing potential for a similar “shooting star” reversal signal. We’ll have to see how it closes at the end of the day today to confirm it.

Market participants may be reluctant to sell off utlility stocks at this point. Utilities are paying above-average dividends to wait out the market uncertainty.

Keep an eye on this, though, especially with the potential reversal signal.

If and when utility stocks underperform the S&P that could be the telltale sign that the market is again in a rally mode, and not simply bouncing higher within a downtrend.