by Michael Tarsala

The S&P 500 chart still looks bad, although Australia’s decision to cut interest rates is something to watch, as it could juice some oversold energy-related asset classes.

And that could eventually be a positive influence for some of the most beaten down stock sectors.

I’ve said this before, but sometimes you have to talk to a forex analyst if you want to find out where stocks are headed. That is especially true in downtrends, when cross-asset classes become correlated.

Forex analysts today have their eye on the Australian dollar, following the rate move. It’s a currency that’s tied very heavily to riskier assets, including materials and energy. And it’s one that is showing some signs of a potential reversal.

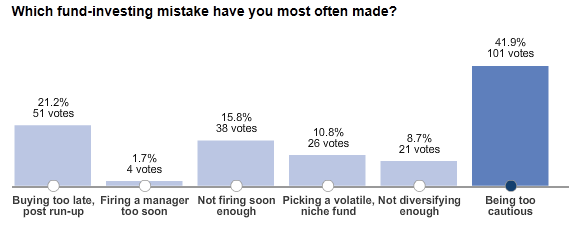

Source: MetaStock

The long candles circled in green on the yellow price action indicate indecision on the part of traders that have ridden the trend down hard since early March.

What you also see just below the yellow price chart is directional movement, a measure of the energy of the trend. This chart shows that the directional movement is at an extreme level, almost exactly where it was in early October. It hasn’t started to fall off yet, but it would be a very positive sign if it did.

Finally, the relative strength index, at the very bottom in red, is now starting to rise from an extreme. You’ll notice that when RSI bottomed out in the past and started to rise again, it was a positive influence for the AUDUSD price.

There is similar indecision right now on the part of crude oil bears.

The inability for traders to push it strongly lower at the close yesterday is a potential sign that a reversal amid oversold conditions could be coming soon.

Why does any of this matter for stocks?

If we do see a turnaround for AUDUSD as well as oil, that could be a positive influence for riskier stock sectors, possibly including energy and materials.

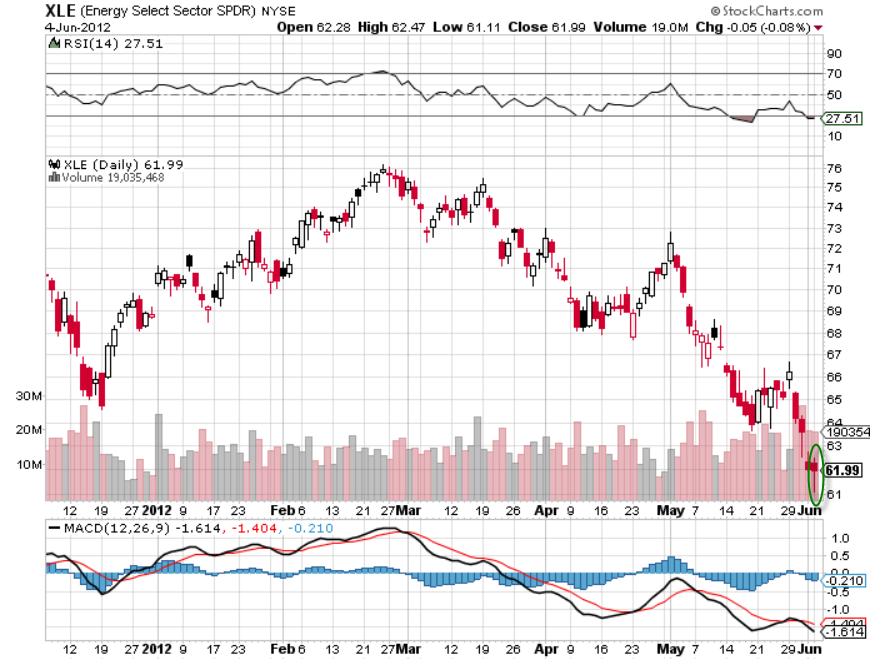

Source: Stockcharts.com

I have my eye on the EnergySelect SPDR ETF (XLE) chart, above. There was similar indecision yesterday on the part of traders that would profit from the price heading even lower.

Again, this is not to say that the S&P or even energy will surely be in rally mode soon. But you have to pay more attention than usual to the markets in a downtrend.

This is something I have my eye on, as these very beaten sectors are unlikely to head straight down forever. Their downtrends are looking long in the tooth.