by Michael Tarsala, CMT

When Mark Faber says something about the markets, you have to pay attention. And just before the worst stock selloff of the year, he had this to say on CNBC:

Today, the markets are overbought. Technically we have deteriorated. We have very heavy insider selling. So a correction is coming.

Of course, we did see a stocks correction this week on renewed worries about Greece. The S&P and Dow seeing their biggest selloff in points for 2012, helping to push bond yields down below 2%, their lowest levels in decades.

So now do you make like former Iron Maiden frontman Bruce Dickinson (you know, “Run to the Hills”)?

Talk to your adviser and make your own call, of course. But here are three things you might want to keep in mind as you think about asset allocations:

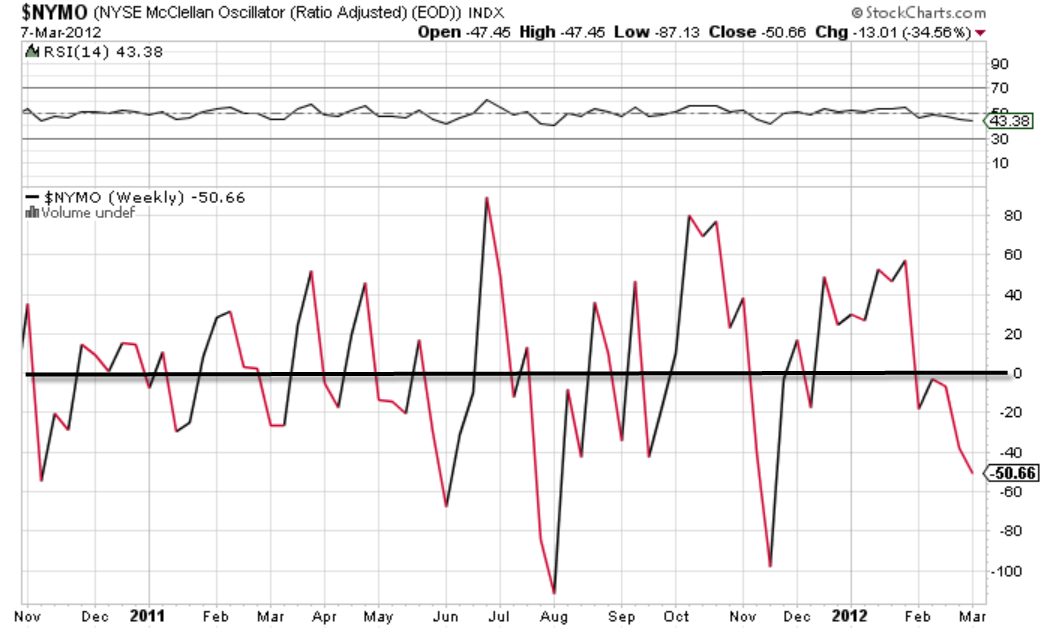

The McClellan is already oversold

This is just one gauge of market breadth, but I consider it to be one of the best. You will see that weekly breadth was waning ahead of the selloff. It quickly reached oversold levels. On the daily chart (the shorter timeframe is more meaningful for traders, not invesors) is now starting to rise again. I would be more concerned about a big selloff if the McClellan remained stubbornly overbought.

Most indexes are back to “normal” standard deviations

Bespoke Investment Group has an insightful post with trading range charts that show each sector’s standard deviation from its 50-day moving average. One interpretation of those charts is that tech and telecom stocks may have a ways to fall still. But most sectors are near the very middle of their ranges, where there is potential technical support.

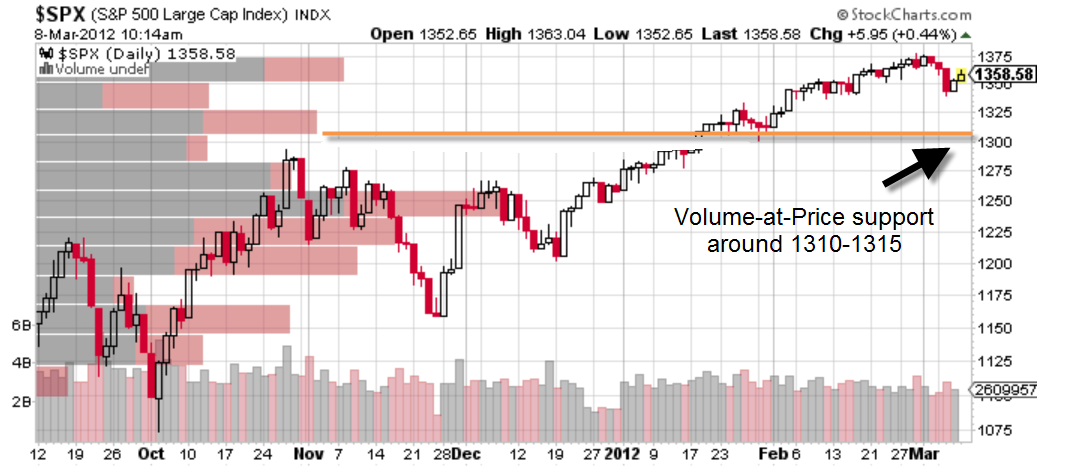

Volume-at-price support remains intact

This chart shows where there is S&P 500 volume support. From that perspective, a daily closing price below 1310 would give reason for deeper technical concern. The reason: The next level of meaningful volume-at-price support is the long bar around 1230 to 1260. For now, the markets remain above that important level.