By Michael Tarsala

It’s not every day that a closed-end fund is a mover and shaker, but a potential catalyst could come as early as this week for Boulder Growth and Income, a CEF that is heavily invested in Berkshire Hathaway and Wal-Mart shares.

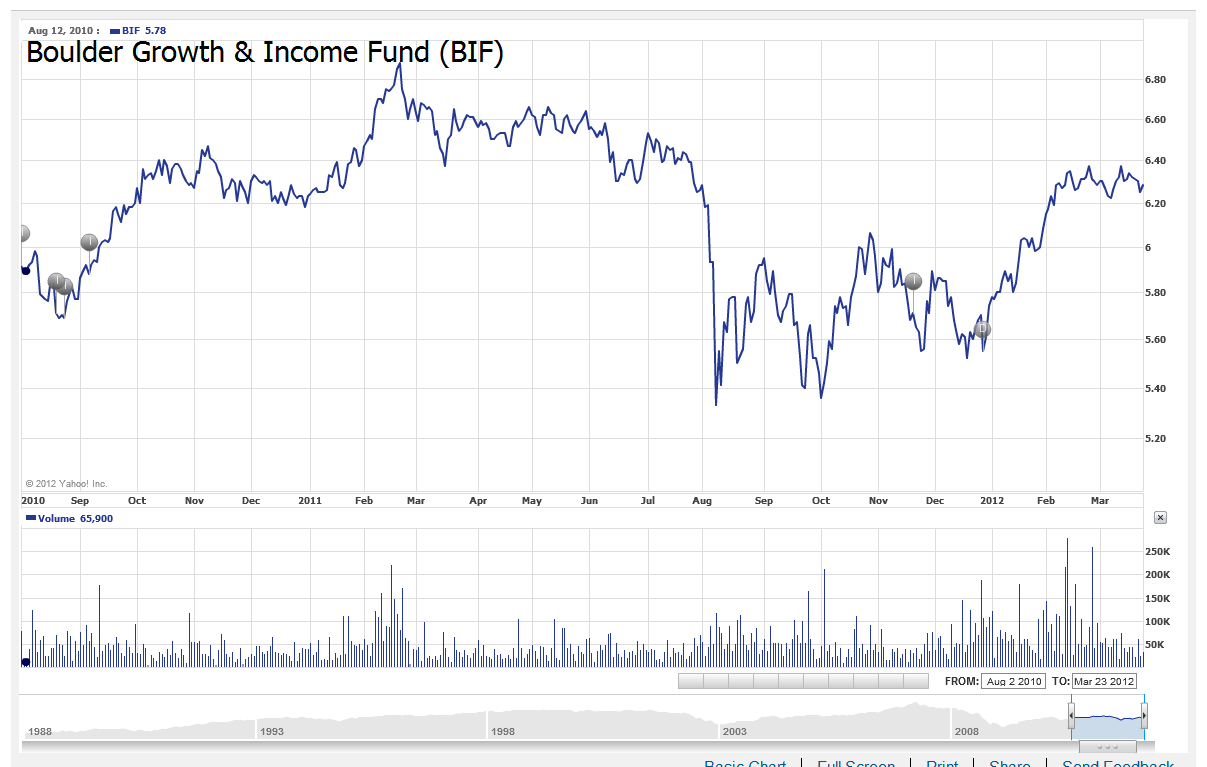

Source: Yahoo Finance

Closed-end funds are collective investments with a limited number of shares. Their values are determined partly by their underlying holdings, as well as the premium or discount placed on them by the market.

Boulder Growth and Income is the largest single investment for three of Dan Plettner’s investment models at Covestor: It makes up 16% of his Core model, and even more of his Long/Short Opportunistic (28%) and Well-Intentioned Activism (15%) offerings.

The fund has more than 35% of its holdings tied to Berkshire A, and Wal-Mart.

Fitch appears comfortable with the financial struture of the fund, based on its AAA debt rating.

The deadline for a final settlement in a shareholder derivative suit is now due, based on the most recent court documents. You can check out the summary of the suit in the company’s latest SEC filing (note 12).

The suit alleged breach of fiduciary duties and unjust enrichment related to the fund’s 2008 rights offering, as well as the board’s decision to suspend the fund’s level rate distribution policy in November 2008.

A settlement in principle was reached on January 20 this year. However, only a final settlement would be expected put the issue to rest for Boulder and its investors.

There appear to be three possible scenarios:

- A final settlement is not reached, and the suit continues.

- The final settlement timeline is pushed back by the courts, or because both parties want more time to negotiate.

- A settlement is reached this week.

The reason to watch for developments is that a settlement could possibly be meaningful to the fund’s valuation. Many closed-end funds trade at a discount. However, the ongoing suit may be one reason Boulder trades at a steeper-than-average discount – about 82 cents on the dollar.