The 17 member states of the Eurozone could issue bonds collectively and accept joint liability for the outstanding debt.

David Callaway at MarketWatch has it right: Market catastrophes rarely happen when everyone is looking.

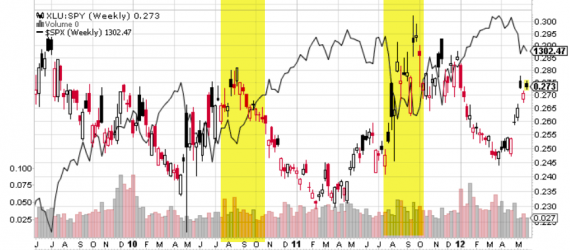

A more aggressive stance from model manager Mike Arold and relative weakness in utility stocks would signal that the market is back in rally mode.

I’d be a fool to compete with the hedge fund talent in knowing when Facebook is a buy or sell post-IPO.

Technical Swing model manager Mike Arold says homebuilder stocks could be the 'trade of the year' in 2012.

I believe the stock is at or near a bottom and is moving forward with a turnaround under the guidance of CEO Craig R. Herkert.

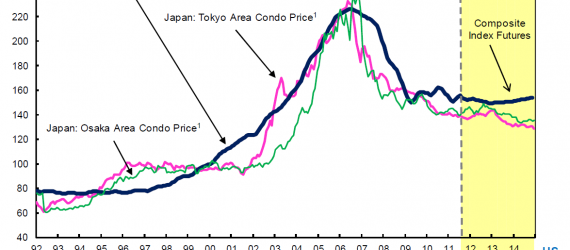

We are now six years into a housing bust that bears an uncomfortable resemblance to the truly epic Japanese property blowout.

Mutual funds force managers to stay fully invested all the time. But if they see trouble coming, Covestor managers can move your account to cash or gold.