Low volatility is still the name of the game at the Dividend and Income Plus model, as shown with the addition of Propect Capital shares.

Outlook

Marketplace's Paddy Hirsch takes to his whiteboard - with some help from 3 little pigs - to explain one of the suggested methods of tackling the European debt crisis

The euro's decline to a two-year low is holding back corporate earnings and it may continue to do so, say Covestor managers.

There are now questions at the Fed as to whether QE3 would even be effective, based on the FOMC minutes, says Dividend and Income Plus manager Bill DeShurko.

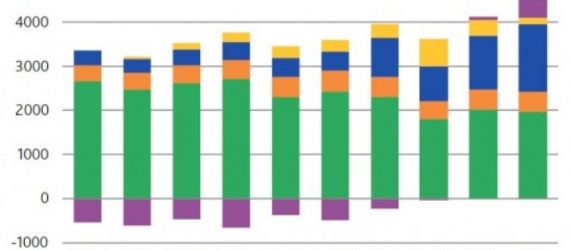

It's sometimes hard to conceptualize the difference between these two very large investing figures. Here's some help.

Sure, risk management and expected payoff are similar. But that's where a reasonable comparison ends.

Alcoa's report is being seen as sign of a troubled earnings season. Analysts that were slow to cut EPS targets across the board may be the bigger worry.

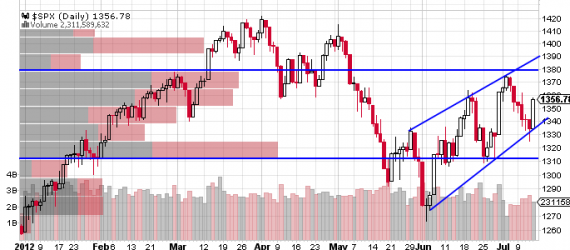

U.S. stocks are selling off for a fifth-straight day. The Fed minutes could be a catalyst, although stocks are not oversold and volatility remains low.

Don't fight the Fed in the gold market and especially not now, argues Chris Henwood of The Henwood Edge and a former trading VP at Goldman's J. Aron.

J.C. Parents, CMT is watching chip stocks as a leading indicator for other markets and perhaps the tech economy. And he likes what he sees.