U.S. stocks stack up well vs. the rest of the world based on valuation, even as the price charts hint at the possibility of coming U.S. outperformance.

Outlook

Two important signals are saying that stocks are not overbought at these levels and the longer-term market trend is still to the upside.

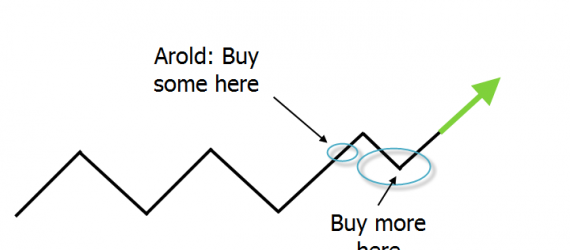

After the QE3-inspired stock rally, here are the three types of technical stock patterns Michael Arold is using as part of his intermediate-term strategy:

Did you know that the S&P 500 is up 16% so far this year and has more than doubled off the 2009 lows? Investors in a recent poll thought stocks were still down.

The fiscal cliff might not be a disaster for dividend stock investors after all, suggests James Morrow, portfolio manager at Fidelity.

The transportation companies are still struggling, and they are sending repeated warning signals about future economic growth.

QE is all about forcing the banks' hand, pushing them to lend cash that will reinvigorate the economy.

You can still find quality dividend-paying stocks in atypical sectors, including technology, says Harvest Financial's John Fattibene.

Piper Jaffray analyst Gene Munster predicts that Apple could sell between 6 and 10 million iPhones this weekend

A possible military strike against Iran by Israel is a potentially significant stock market threat that is somehow still flying under the radar.

Stocks are near five-year highs. Market breadth has improved greatly. Still, there’s one group that is looking green around the gills: Utilities