by Michael Tarsala, CMT

One market warning siren that is blaring above all the others right now: The low volatility index.

Think of volatility as fuel for market rallies. If you are a market bull, high and declining volatility is exactly what you want to see. The biggest moves to the upside in recent years has happened when volatility was being “burned off” over a period of months.

The opposite is also true: If you are bearish, low and rising volatility is your nirvana. Some of the biggest declines in recent years happened when all the volatility fuel was drained from the tank, and it was time for a refill.

Right now, the market’s main volatility fuel gauge – the VIX – is sitting near levels not seen since the middle of 2007 – just ahead of the all-time peak for the S&P 500 that year. It is not rising from that low level, but that is the major concern.

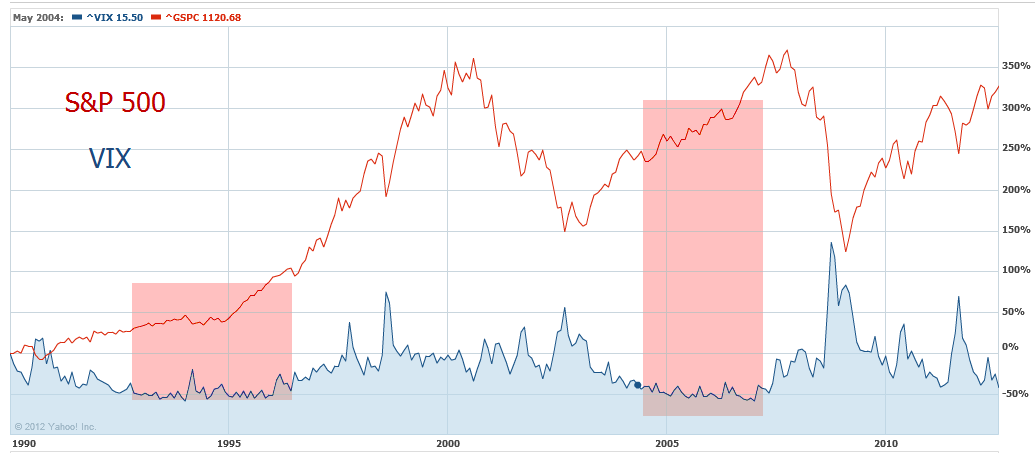

Four declines in the past two years alone came on similarly low VIX levels, as you can see in the following chart from Market Tech Reports.

Source: Market Tech Reports

Going back further in time, however, there is little to suggest that the VIX cannot move even lower than its current level, between 14 and 15.The VIX was between 12 and 14 for most of 1993 through 1995. Mid 2005 and 2006 saw similarly low VIX levels.

Source: Yahoo Finance

Regardless, even a four-point move lower that would send the VIX to a 20-year low would still not provide very much “fuel” for the current rally.

To the contrary, the market’s complacency leaves it susceptible to shocks – ones that could come from Europe, a Chinese economic slowdown, new tax policies as a result of the U.S. presidential election, or even a military flare-up.

Are you positioned to weather higher volatility? If you have questions or want to learn more about our low-volatility investment options, call Covestor, at 866-825-3005, X 703, from 9 to 5, Monday through Friday, Eastern. You can ask for Bhargav in our New York office.

At Covestor, we can set you up with your own separately managed account (your money is separate from everyone else’s) – all with very low investment minimums.