It seems as though the Treasury may be preparing the market for a potential change in issuance sizes or duration at some point in the not-too-distant future, though that is admittedly speculative.

As we get ready to close out 2025, one stand-out trend in the U.S. Treasury (UST) market has been the steepening of the yield curve. The question now is whether this trend will continue into 2026, and if it does, how should investors position their bond portfolios?

Stocks posted solid gains in an action-packed week of market-moving economic data, geopolitical news, and bullish new year sentiment. By Monday’s close, the Dow Industrials had gained enough to make the “Santa Claus Rally” a reality.

While the near-term market effect of the US capture of Venezuelan President Nicolas Maduro is minimal—beyond select US oil refiners, Venezuelan sovereign bonds, etc.—Maduro’s capture is a major geopolitical event with profound implications for the future.

The paper analyzes FTSE Russell’s decision to transition the frequency of reconstitution of the Russell US Indexes from annual to semi-annual from 2026 onwards.

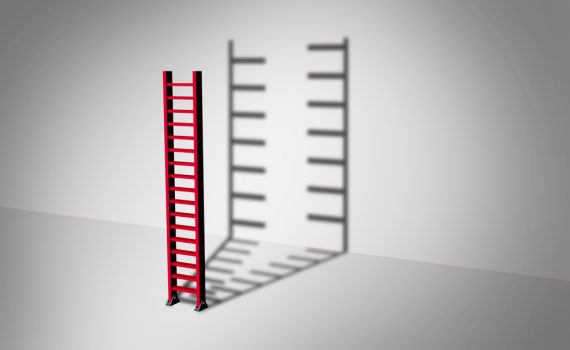

Interactive Advisors is ringing in the new year with a new logo! Our updated logo reflects the same core ideas of support, care and cooperation that have defined us since our inception.

An eventful weekend featuring the ousting and arrest of communist Venezuelan dictator Nicolas Maduro is generating outperformance in the energy sector as the US oil majors are poised to benefit from Washington’s control of the crude rich nation.

The implied volatility selling that really started around Thanksgiving and then reemerged during Christmas now appears largely complete. The calendar will no longer be the market’s friend.

As 2025 ends, investors increasingly allocated capital to geographies where economic conditions were moving more favorably.

While only two official dissenters opposed the December rate cut, dot-plot projections reveal that six Fed members, including four “silent dissenters,” were against easing, signaling deeper division within the Fed than headlines suggest.

The tactical USD view moved from neutral to negative as a dovish Fed pivot pressured the currency. Softer labor data and rising expectations of a December rate cut halted the earlier USD recovery and kept it rangebound.

As the holiday season rounds up, gather your close ones and enjoy the festivities together. But make sure you do not forget to plan for the rain in advance.