By: Samuel Rines, Macro Strategist, Model

Welcome to the latest installment of our new blog series, Navigating Earnings Season. In this series, I dive into the world of earnings reports from major companies, spanning giants like JP Morgan and Pepsi, as well as niche players in various sectors. As the earnings season unfolds, these corporate outlooks offer real-world insights that often contrast sharply with the uncertainty emanating from the Federal Open Market Committee (FOMC).

Earnings season has been overshadowed by various bouts of carry trade unwinds and the resulting sharp movements in equity indexes globally. That is understandable. It is difficult to focus on the fundamentals when they do not seem to matter. But that would be a mistake. We believe when the dust settles, markets will begin to refocus attention on results. And some of them have been rather surprising.

Tyson Foods

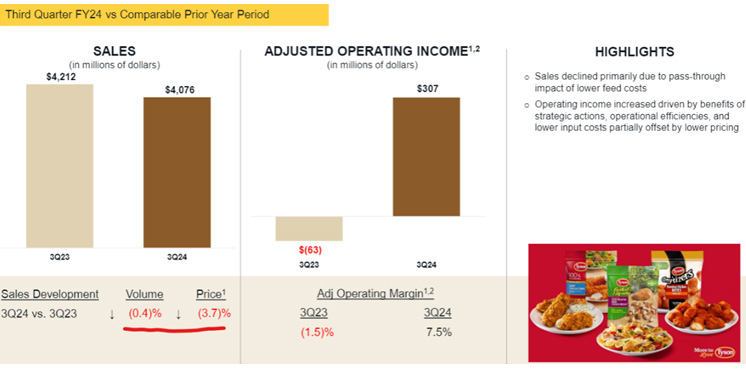

Source: Tyson Foods Q3 Fiscal 2024 Supplemental Information, 8/5/24 (emphasis added).

Tyson Foods is largely a protein commodity company. But that description masks its position as an often-overlooked part of the market with useful informational value. This quarter showed something of an oddity. Price and volume were both negative. Selling less chicken at a lower price definitionally leads to a lower revenue line. Normally, this would be problematic. This time, it was not.

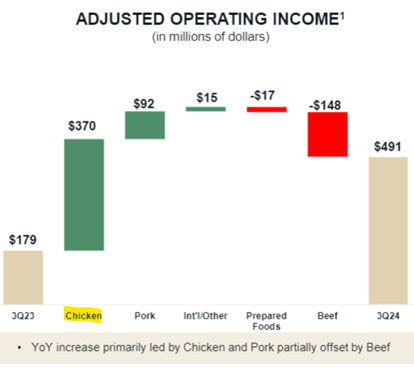

Source: Tyson Foods Q3 Fiscal 2024 Supplemental Information, 8/5/24

(emphasis added).

The oddity is that lower revenue came with much higher profitability. Why? Feed costs fell (some of it was passed on through lower prices), input costs were lower and there were “operational efficiencies” (usually fewer workers). While the revenue line is a simple calculation of price multiplied by volume, the profit line is not quite so straightforward. Selling less does not mean lower profits when it costs less to grow and process the chickens.

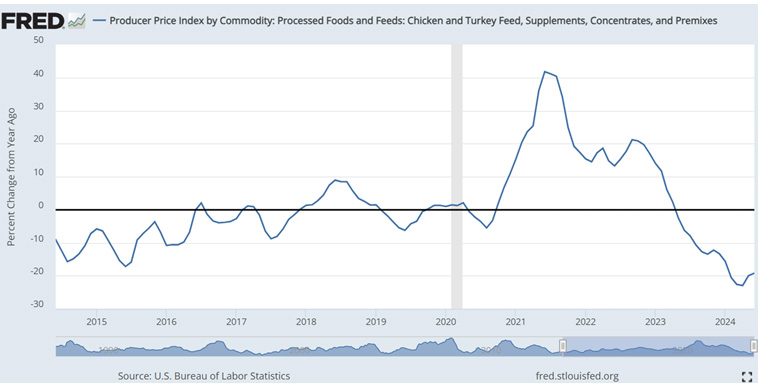

Producer Price Index by Commodity: Processed Foods and Feeds: Chicken and Turkey Feed, Supplements, Concentrates and Premixes

Source: St. Louis Federal Reserve, Bureau of Labor Statistics, as of 8/6/24.

Yes, there is an index for chicken feed prices. And it has declined precipitously from its dual crisis highs (COVID and Russia’s invasion of Ukraine). That dynamic—lackluster revenues with improving cost structures and better bottom lines—is not a one-off phenomenon either.

Yum! Brands

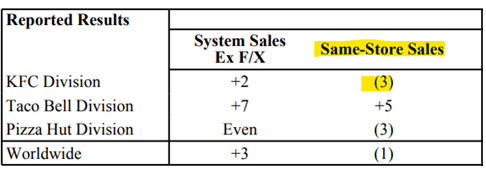

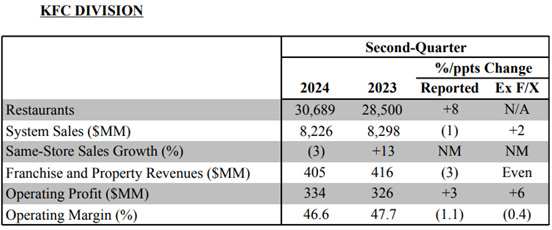

Source: Yum! Brands Second Quarter Results, 8/6/24. System sales growth figures exclude

foreign currency translation (“F/X”) (emphasis added).

There is perhaps no chicken brand more recognizable than KFC. The Colonel’s sales did not go all that well in the last quarter, however. Their same-store sales metric (which measures sales at stores open at least a year) declined 3%, with the U.S. measure declining 5%. On the surface, it could be worse. But—with a seemingly ever-increasing selection of establishments selling fried chicken—it may also be something else entirely.

Source: Yum! Brands Second Quarter Results, 8/6/24.

After all, KFC also reported their store count grew 8% year on year to 30,689. Despite the rapid growth in store count, revenues were down due to the drag from the existing ones. And, unlike Tyson, margins did not improve and there was deleveraging in the system. As it turns out, not all chicken is the same.

Granted, Yum! also owns Taco Bell. And it had a great quarter. The consumer is becoming “choosy” with its spending but is certainly not pulling back meaningfully.

Caterpillar

Source: Caterpillar 2Q 2024 Earnings Release, 8/6/24 (emphasis added).

Then comes Caterpillar. Which has little to do with the consumer or chicken, but quite a bit to do with price flowing to profits. COVID was unkind to Cat, like most manufacturers. There were disruptions and parts delays leading to depleted dealer inventories. There was a catch-up period of “overproduction” to get dealers back to normal levels. Prices were increased due to labor and other input costs. Volumes were a secondary consideration.

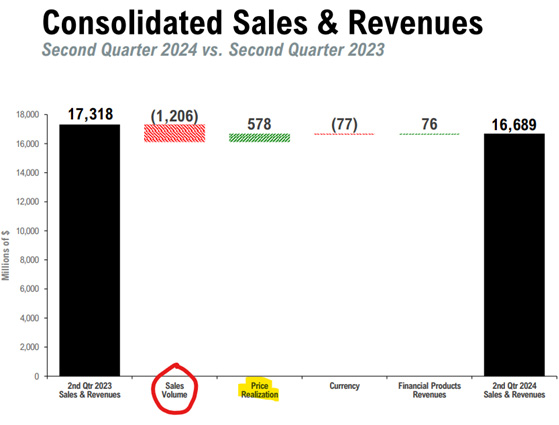

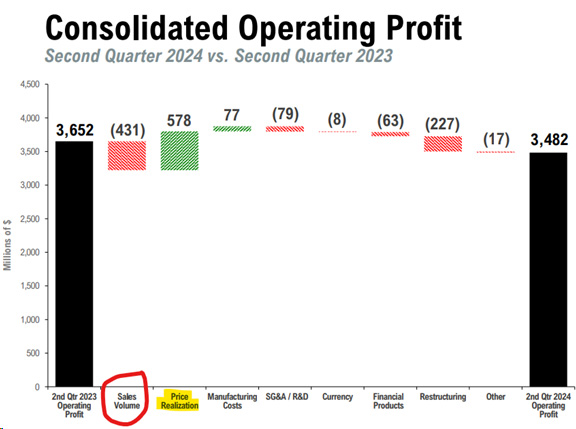

Fast-forward to the current quarter. Volumes declined meaningfully, and price did not quite make up for it. Revenues declined.

Source: Caterpillar 2Q 2024 Earnings Release, 8/6/24 (emphasis added).

Kindly, Caterpillar made it clear how powerful pricing is for the profit calculus. The entirety of the pricing power flows through to operating profit. Changing a price tag does not cost anything. Not to mention, the sales volume decline did not detract as much as the price increases added. Again, that is important. Price flows through to the bottom line. Given the numerous companies who successfully raised prices over the last few years, there may be plenty of prices left to flow through.

Originally Posted August 8th, 2024, WisdomTree

PHOTO CREDIT: https://www.shutterstock.com/g/Uuganaa

Via SHUTTERSTOCK

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see the prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.